Delta Airlines 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

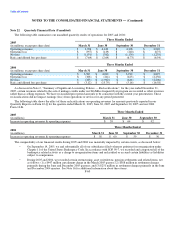

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

contributions to the MPPP ceased effective December 31, 2004, individual accounts will continue to be credited with investment

gains/losses and the actuarial equivalent of the accumulated account balance at retirement will continue to offset the participants

defined benefit pension benefit.

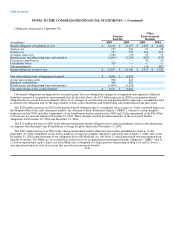

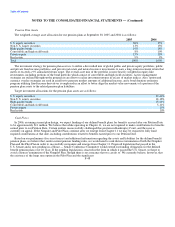

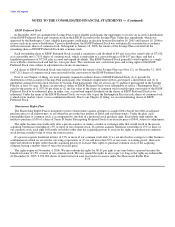

Delta Family-Care Savings Plan ("Savings Plan")

Eligible employees may contribute a portion of their covered pay to the Savings Plan. Generally, we match 50% of nonpilot

employee contributions with a maximum employer contribution of 2% of a participant's covered pay. In 2003 and 2004, we provided

all eligible Delta pilots with an employer contribution of 3% of their covered pay. Effective January 1, 2005, the employer

contribution for eligible Delta pilots was reduced to 2% of their covered pay. Prior to the Petition Date, we generally made our

contributions for nonpilots and pilots by allocating Series B ESOP Convertible Preferred Stock ("ESOP Preferred Stock"), common

stock or cash to the Savings Plan. Effective on the Petition Date, we began making all company contributions to the Savings Plan in

cash. Our contributions, which are recorded as salaries and related costs in our Consolidated Statements of Operations, totaled

$56 million, $85 million and $81 million for the years ended December 31, 2005, 2004 and 2003, respectively.

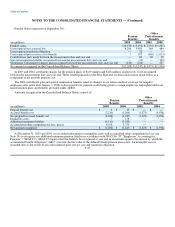

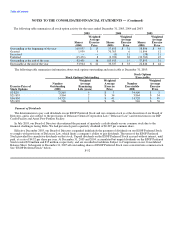

Our Savings Plan includes an employee stock ownership plan ("ESOP") feature. When we adopted the ESOP in 1989, we sold

6,944,450 shares of ESOP Preferred Stock to the Savings Plan for $500 million. We have recorded unearned compensation equal to

the value of the shares of ESOP Preferred Stock not yet allocated to participants' accounts. We reduced the unearned compensation as

shares of ESOP Preferred Stock were allocated to participants' accounts. At December 31, 2005, 3,510,490 shares of ESOP Preferred

Stock were allocated to participants' accounts, and 1,157,078 shares were held by the ESOP for future allocations. Subsequent to

December 31, 2005, all unallocated ESOP Preferred stock was allocated to participants and converted to common stock. See Note 13

for additional information.

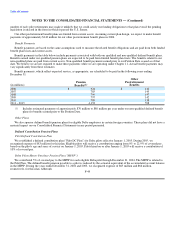

Cash Flows

We expect to contribute approximately $100 million to our defined contribution pension plans in 2006.

Other Plans

Comair and DAL Global Services, Inc., two of our wholly owned subsidiaries, sponsor defined contribution retirement plans for

eligible employees. Additionally, we sponsor defined contribution plans for eligible Delta employees in certain foreign countries.

These plans did not have a material impact on our Consolidated Financial Statements in any period presented.

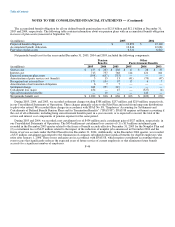

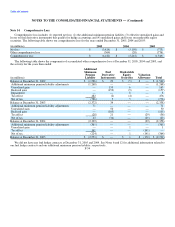

Postemployment Benefits

We provide certain other welfare benefits to eligible former or inactive employees after employment but before retirement,

primarily as part of the disability and survivorship plans. Postemployment benefit expense was $107 million, $105 million and

$131 million for the years ended December 31, 2005, 2004 and 2003, respectively. We include the amount funded in excess of the

liability in other noncurrent assets on our Consolidated Balance Sheets. Future period expenses will vary based on actual claims

experience and the return on plan assets. Gains and losses occur because actual experience differs from assumed experience. Gains

and losses and prior service costs related to our disability and survivorship plans are amortized over the average future service period

of employees covered by these plans.

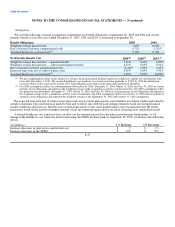

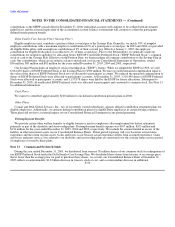

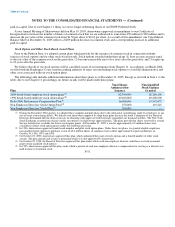

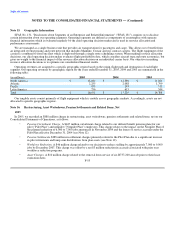

Note 13. Common and Preferred Stock

During the year ended December 31, 2005, we distributed from treasury 38 million shares of our common stock for redemptions of

our ESOP Preferred Stock under the Delta Family-Care Savings Plan. We distributed these shares from treasury at an average price

that is lower than the average price we paid to purchase these shares. As a result, our Consolidated Balance Sheet at December 31,

2005 reflects an approximately $1.8 billion decrease in treasury stock at cost, and a corresponding decrease in additional

F-50