Delta Airlines 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

amount that we may be required to pay in these circumstances may be materially different from these estimates.

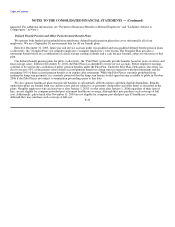

Legal Contingencies

We are involved in various legal proceedings relating to antitrust matters, employment practices, environmental issues and other

matters concerning our business. We cannot reasonably estimate the potential loss for certain legal proceedings because, for example,

the litigation is in its early stages or the plaintiff does not specify the damages being sought.

As a result of our Chapter 11 proceedings, virtually all pre-petition pending litigation against us is stayed and related amounts

accrued have been classified in liabilities subject to compromise on the Consolidated Balance Sheet at December 31, 2005.

Other Contingencies

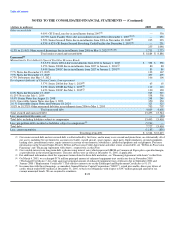

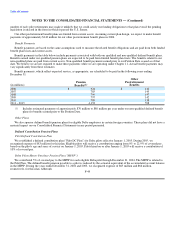

Regional Airports Improvement Corporation ("RAIC")

We have obligations under a facilities agreement with the RAIC to pay the bond trustee amounts sufficient to pay the debt service

on $47 million in Facilities Sublease Refunding Revenue Bonds. These bonds were issued in 1996 to refinance the construction of

certain airport and terminal facilities we use at Los Angeles International Airport. We also provide a guarantee to the bond trustee

covering payment of the debt service.

General Indemnifications

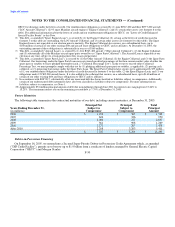

We are the lessee under many real estate leases. It is common in these commercial lease transactions for us, as the lessee, to agree

to indemnify the lessor and other related third parties for tort, environmental and other liabilities that arise out of or relate to our use or

occupancy of the leased premises. This type of indemnity would typically make us responsible to indemnified parties for liabilities

arising out of the conduct of, among others, contractors, licensees and invitees at or in connection with the use or occupancy of the

leased premises. This indemnity often extends to related liabilities arising from the negligence of the indemnified parties, but usually

excludes any liabilities caused by either their sole or gross negligence and their willful misconduct.

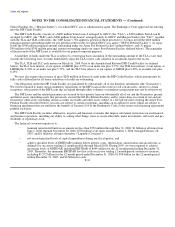

Our aircraft and other equipment lease and financing agreements typically contain provisions requiring us, as the lessee or obligor,

to indemnify the other parties to those agreements, including certain related parties, against virtually any liabilities that might arise

from the condition, use or operation of the aircraft or such other equipment.

We believe that our insurance would cover most of our exposure to such liabilities and related indemnities associated with the

types of lease and financing agreements described above, including real estate leases.

Certain of our aircraft and other financing transactions include provisions which require us to make payments to preserve an

expected economic return to the lenders if that economic return is diminished due to certain changes in law or regulations. In certain

of these financing transactions, we also bear the risk of certain changes in tax laws that would subject payments to non-U.S. lenders to

withholding taxes.

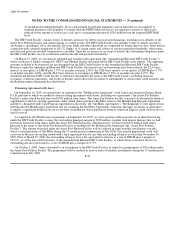

We cannot reasonably estimate our potential future payments under the indemnities and related provisions described above

because we cannot predict (1) when and under what circumstances these provisions may be triggered and (2) the amount that would be

payable if the provisions were triggered because the amounts would be based on facts and circumstances existing at such time. We

also cannot predict the impact, if any, that our Chapter 11 proceedings might have on these obligations.

F-39