Delta Airlines 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

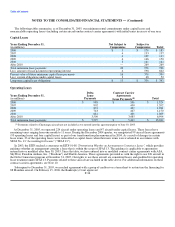

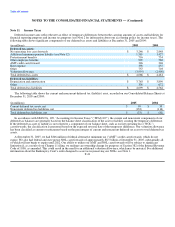

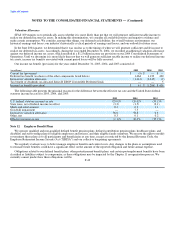

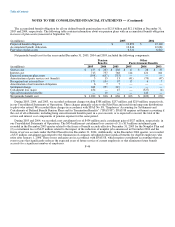

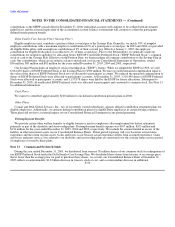

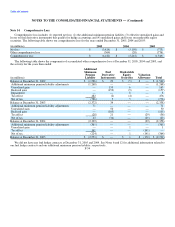

Obligations (measured at September 30):

Other

Pension Postretirement

Benefits Benefits

(in millions) 2005 2004 2005 2004

Benefit obligation at beginning of year $ 12,140 $ 12,477 $ 1,835 $ 2,260

Service cost 155 233 17 28

Interest cost 715 757 114 121

Actuarial (gain) loss 1,262 (35) 33 71

Benefits paid, including lump sums and annuities (1,699) (1,292) (187) (178)

Participant contributions — — 32 20

Curtailment losses 320 — — —

Plan amendments — — (51) (487)

Benefit obligation at end of year $ 12,893 $ 12,140 $ 1,793 $ 1,835

Fair value of plan assets at beginning of period $ 6,842 $ 6,818

Actual gain on plan assets 988 821

Employer contributions 390 495

Benefits paid, including lump sums and annuities (1,699) (1,292)

Fair value of plan assets at end of period $ 6,521 $ 6,842

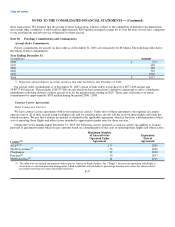

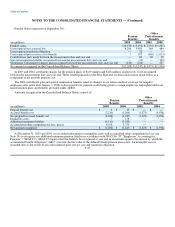

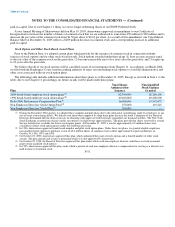

Our benefit obligations are impacted by actuarial (gains) losses resulting from changes in assumptions and experience different

from that assumed at our previous measurement date. In the table above, the $1.3 billion increase in 2005 in our pension benefit

obligation due to actuarial losses primarily relates to (1) changes in our discount rate and participant life expectancy assumptions used

to measure the obligation and (2) the large number of early pilot retirements and related lump sum distributions from plan assets.

The $320 million increase in 2005 in the pension benefit obligation due to curtailment losses relates to (1) the combined impact on

the Nonpilot Plan of the early retirement window, the Alternative Early Retirement Option ("AERO"), offered to certain nonpilot

employees in late 2004 and other components of our transformation plan announced in 2004 and (2) the amendment of the Pilot Plan

to freeze service accruals effective December 31, 2004. These changes resulted in remeasurements of the associated benefit

obligations on November 30, 2004 and December 31, 2004.

The $51 million decrease in 2005 in the other postretirement benefit obligation due to plan amendments relates to the elimination

of company subsidized post-age 65 healthcare coverage for pilots hired after November 11, 2004.

The $487 million decrease in 2004 in the other postretirement benefit obligation due to plan amendments relates to (1) the

September 30, 2004 amendment of our retiree medical coverage for nonpilot employees who retire after January 1, 2006, and (2) the

December 31, 2003 remeasurement of our obligation due to the Medicare Act (see Note 2), which introduced new prescription drug

benefits to retirees. The Medicare Act resulted in a reduction in our accumulated postretirement benefits obligation ("APBO") due to

(1) lower expected per capita claims cost from Medicare's assumption of a larger portion of prescription drug costs and (2) lower

anticipated participation rates in our plans that provide postretirement benefits.

F-44