Delta Airlines 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

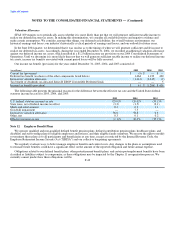

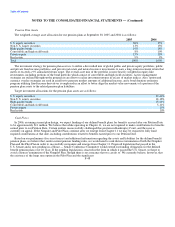

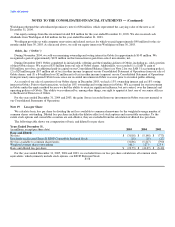

Pension Plan Assets

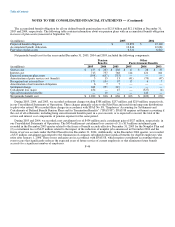

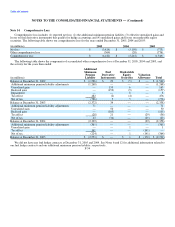

The weighted-average asset allocation for our pension plans at September 30, 2005 and 2004 is as follows:

2005 2004

U.S. equity securities 36% 35%

Non-U.S. equity securities 13% 15%

High quality bonds 19% 18%

Convertible and high yield bonds 8% 10%

Private equity 15% 13%

Real estate 9% 9%

Total 100% 100%

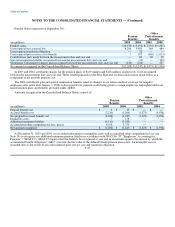

The investment strategy for pension plan assets is to utilize a diversified mix of global public and private equity portfolios, public

and private fixed income portfolios, and private real estate and natural resource investments to earn a long-term investment return that

meets or exceeds a 9% annualized return target. The overall asset mix of the portfolio is more heavily weighted in equity-like

investments, including portions of the bond portfolio which consist of convertible and high yield securities. Active management

strategies are utilized throughout the program in an effort to realize investment returns in excess of market indices. Also, option and

currency overlay strategies are used in an effort to generate modest amounts of additional income, and a bond duration extension

program utilizing fixed income derivatives is employed in an effort to better align the market value movements of a portion of the

pension plan assets to the related pension plan liabilities.

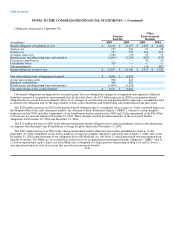

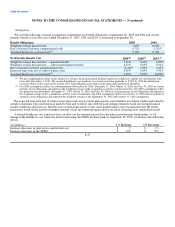

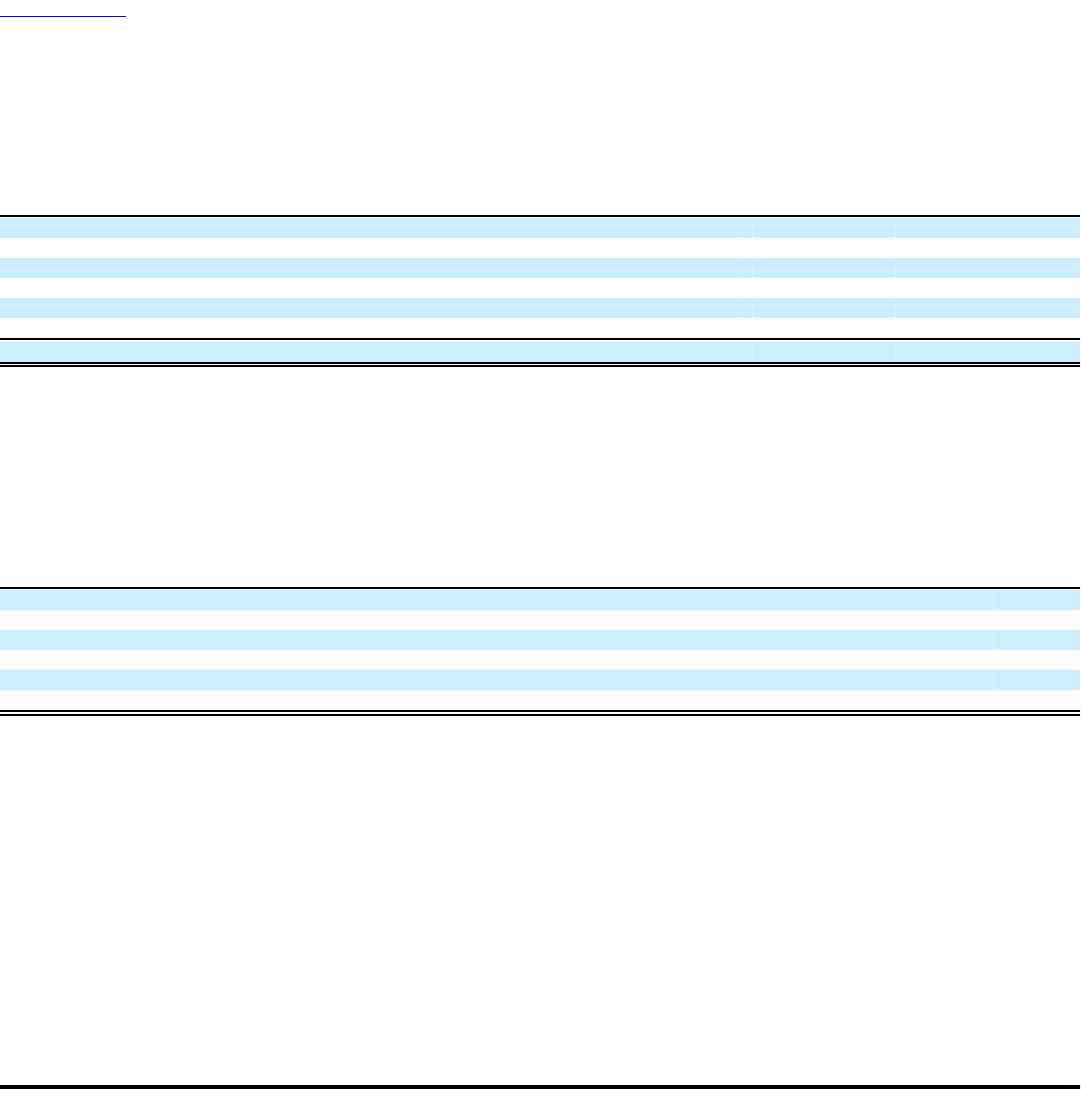

Target investment allocations for the pension plan assets are as follows:

U.S. equity securities 27-41%

Non-U.S. equity securities 12-18%

High quality bonds 15-21%

Convertible and high yield bonds 5-11%

Private equity 15%

Real estate 10%

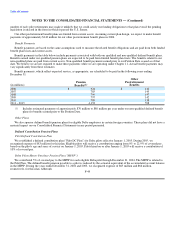

Cash Flows

In 2006, assuming current plan design, we expect funding of our defined benefit plans for benefits accrued after our Petition Date

to be approximately $11 million. We believe that while operating in Chapter 11, we are not required to make contributions for benefits

earned prior to our Petition Date. Certain entities unsuccessfully challenged this position in Bankruptcy Court, and the issue is

currently on appeal. If the Nonpilot and Pilot Plans continue after we emerge from Chapter 11 we may be required to fully fund

required contributions at that date, including contributions related to benefits earned prior to our Petition Date.

Based on our preliminary five-year forecast and additional information regarding the assets and liabilities for the defined benefit

pension plans, we believe that, under current pension funding rules, we would need to seek distress termination of both the Nonpilot

Plan and the Pilot Plan in order to successfully reorganize and emerge from Chapter 11. Proposed legislation that passed in the

U.S. Senate and is now pending in a House — Senate Conference Committee would extend our funding obligations for the defined

benefit pension plans over 20 years. If the pending legislation is enacted in the form in which it passed the U.S. Senate, we hope to

avoid a distress termination of the Nonpilot Plan, though there is no assurance that we can do so. We currently believe, however, that

the existence of the lump sum option in the Pilot Plan and the significant

F-48