Delta Airlines 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142

|

|

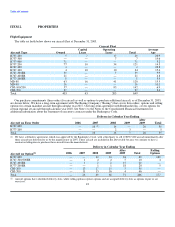

Table of Contents

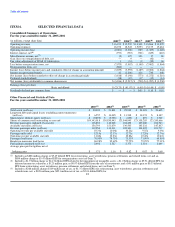

Appropriations Act compensation; and a $304 million gain ($191 million net of tax, or $1.55 diluted EPS) for certain other income and expense

items (see Item 7).

(4) Includes a $439 million charge ($277 million net of tax, or $2.25 diluted EPS) for restructuring, asset writedowns, and related items, net; a

$34 million gain ($22 million net of tax, or $0.17 diluted EPS) for Stabilization Act compensation; and a $94 million charge ($59 million net of

tax, or $0.47 diluted EPS) for certain other income and expense items (see Item 7).

(5) Includes a $1.1 billion charge ($695 million net of tax, or $5.63 diluted EPS) for restructuring, asset writedowns, and related items, net; a

$634 million gain ($392 million net of tax, or $3.18 diluted EPS) for Stabilization Act compensation; and a $186 million gain ($114 million net

of tax, or $0.92 diluted EPS) for certain other income and expense items (see Item 7).

(6) Includes interest income.

(7) Includes gains (losses) from the sale of investments. 24