Delta Airlines 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

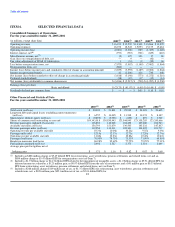

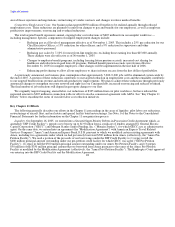

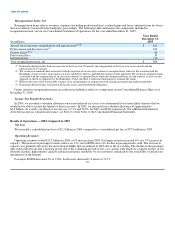

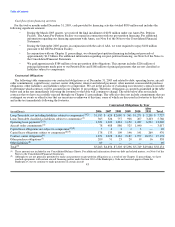

Operating Expenses

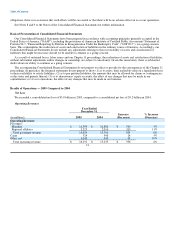

Year Ended

December 31,

Increase % Increase

(in millions) 2005 2004 (Decrease) (Decrease)

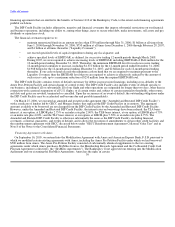

Operating Expenses:

Salaries and related costs $ 5,058 $ 6,338 $ (1,280) (20)%

Aircraft fuel 4,271 2,924 1,347 46%

Depreciation and amortization 1,273 1,244 29 2%

Contracted services 1,096 999 97 10%

Contract carrier arrangements 1,318 932 386 41%

Landing fees and other rents 863 875 (12) (1)%

Aircraft maintenance materials and outside repairs 776 681 95 14%

Aircraft rent 541 716 (175) (24)%

Passenger commissions and other selling expenses 948 939 9 1%

Passenger service 345 349 (4) (1)%

Impairment of intangible assets — 1,875 (1,875) NM

Restructuring, asset writedowns, pension settlements and related items, net 888 (41) 929 NM

Other 815 712 103 14%

Total operating expenses $ 18,192 $ 18,543 $ (351) (2)%

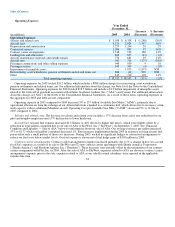

Operating expenses for 2005 totaled $18.2 billion, which includes a $888 million charge for restructuring, asset writedowns,

pension settlements and related items, net. For additional information about this charge, see Note 16 of the Notes to the Consolidated

Financial Statements. Operating expenses for 2004 totaled $18.5 billion and include a $1.9 billion impairment of intangible assets

related to the write-off of goodwill associated with Atlantic Southeast Airlines, Inc. ("ASA") and Comair. For additional information

about this charge, see Note 7 of the Notes to the Consolidated Financial Statements. As a result of these items, operating expenses in

the aggregate for 2005 and 2004 are not comparable.

Operating capacity in 2005 compared to 2004 increased 3% to 157 billion Available Seat Miles ("ASMs"), primarily due to

operational efficiencies from the redesign of our Atlanta hub from a banked to a continuous hub, which allowed us to increase system-

wide capacity with no additional Mainline aircraft. Operating Cost per Available Seat Mile ("CASM") decreased 5% to 11.60¢ in

2005 compared to 2004.

Salaries and related costs. The decrease in salaries and related costs includes a 17% decrease from salary rate reductions for our

pilot and nonpilot employees and a 7% decline due to lower headcount.

Aircraft fuel. Aircraft fuel expense increased $1.3 billion, or 46% driven by higher fuel prices, which were slightly offset by a

reduction in total gallons consumed due to our sale of ASA to SkyWest, Inc. ("SkyWest") on September 7, 2005. See "Financial

Condition and Liquidity — Sale of ASA" below for information about our sale of ASA. Our average fuel price per gallon increased

47% to $1.71 while total gallons consumed decreased 1%. Fare increases implemented during 2005 in response to rising aircraft fuel

prices offset only a small portion of those cost increases. During 2005, we had no significant hedges or contractual arrangements to

reduce our fuel costs below market levels. Our fuel expense is shown net of fuel hedge gains of $105 million in 2004.

Contract carrier arrangements. Contract carrier arrangements expense increased primarily due to (1) a change in how we account

for ASA's expenses as a result of its sale to SkyWest and (2) new contract carrier agreements with Shuttle America Corporation

("Shuttle America") and Freedom Airlines, Inc. ("Freedom"). These increases were partially offset by the termination of our contract

carrier arrangement with Flyi, Inc. in 2004. After the sale of ASA to SkyWest, expenses related to ASA are shown as contract carrier

arrangements expense; prior to the sale, expenses related to ASA as our wholly owned subsidiary were reported in the applicable

expense line item. 33