Delta Airlines 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

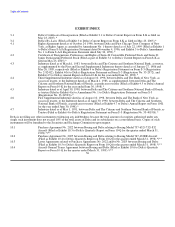

Table of Contents

in 2006. Estimates on variable rate interest were calculated using implied short term LIBOR rates based on LIBOR at February 1,

2006. The related payments represent credit enhancements required in conjunction with certain financing agreements. As a result of

our Chapter 11 filing, actual interest expense in 2006 is expected to be less than the contractual interest expense. See Note 2 of the

Notes to the Consolidated Financial Statements for information about our policy relating to interest expense.

Legal Contingencies. We are involved in various legal proceedings relating to antitrust matters, employment practices,

environmental issues and other matters concerning our business. We cannot reasonably estimate the potential loss for certain legal

proceedings because, for example, the litigation is in its early stages or the plaintiff does not specify the damages being sought.

As a result of our Chapter 11 proceedings, virtually all pre-petition pending litigation against us is stayed and related amounts

accrued have been classified in liabilities subject to compromise on the Consolidated Balance Sheet at December 31, 2005.

Other Contingent Obligations under Contracts. In addition to the contractual obligations discussed above, we have certain

contracts for goods and services that require us to pay a penalty, acquire inventory specific to us or purchase contract specific

equipment, as defined by each respective contract, if we terminate the contract without cause prior to its expiration date. These

obligations are contingent upon whether we terminate the contract without cause prior to its expiration date; therefore, no obligation

would exist unless such a termination were to occur. We also cannot predict the impact, if any, that our Chapter 11 proceedings might

have on these obligations.

For additional information about other contingencies not discussed above as well as discussions related to general

indemnifications, see Note 10 of the Notes to the Consolidated Financial Statements.

Application of Critical Accounting Policies

Critical Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to make certain estimates and

assumptions. We periodically evaluate these estimates and assumptions, which are based on historical experience, changes in the

business environment and other factors that management believes to be reasonable under the circumstances. Actual results may differ

materially from these estimates.

Revenue Recognition — Passenger Revenue. We record sales of passenger tickets as air traffic liabilities on our Consolidated

Balance Sheets. Passenger revenues are recognized when we provide transportation, reducing the related air traffic liability. We

periodically evaluate the estimated air traffic liability and record any resulting adjustments in our Consolidated Statements of

Operations in the period in which the evaluations are completed.

We sell mileage credits in our SkyMiles frequent flyer program to participating partners such as credit card companies, hotels and

car rental agencies. The portion of the revenue from the sale of mileage credits that approximates the fair value of travel to be

provided is deferred. We amortize the deferred revenue on a straight-line basis over the period when transportation is expected to be

provided. The majority of the revenue from the sale of mileage credits, including the amortization of deferred revenue, is recorded in

passenger revenue on our Consolidated Statements of Operations; the remaining portion is recognized in income currently and is

classified as other revenue.

Frequent Flyer Program Liability. We have a frequent flyer program, the SkyMiles Program, offering incentives to increase travel

on Delta. This program allows participants to earn mileage for travel awards by flying on Delta, Delta Connection carriers and

participating airlines, as well as through participating partners such as credit card companies, hotels and car rental agencies. Mileage

credits can be redeemed for free or upgraded air travel on Delta and participating airline partners, for membership in our Crown

Room Club and for other program partner awards.

We record a liability for the estimated incremental cost of flight awards which are earned under our SkyMiles frequent flyer

program and expected to be redeemed for travel on Delta or other airline partners. Our incremental costs include (1) our system

average cost per passenger for fuel, food and other direct passenger costs for awards to be redeemed on Delta and (2) contractual costs

for awards to be redeemed on 46