DIRECTV 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

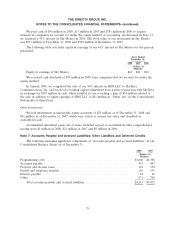

As of December 31, 2008, our unrecognized tax benefits totaled $425 million, including accrued

interest of $62 million. If our tax positions are ultimately sustained, approximately $207 million of the

unrecognized tax benefits would be recognized as a reduction in our annual effective income tax rate.

We recorded $16 million of interest and penalties in ‘‘Income tax expense’’ in the Consolidated

Statements of Operations during the year ended December 31, 2008 for unrecognized tax benefits.

We file numerous consolidated and separate income tax returns in the U.S. federal jurisdiction and

in many state and foreign jurisdictions. For U.S. federal tax purposes, the tax years 2003 through 2008

remain open to examination. The California tax years 1994 through 2008 remain open to examination

and the income tax returns in the other state and foreign tax jurisdictions in which we have operations

are generally subject to examination for a period of 3 to 5 years after filing of the respective return.

We anticipate that the examination and court proceedings for certain state taxing jurisdictions will

conclude in the next twelve months resulting in an estimated reduction in our unrecognized tax benefits

of approximately $35 million, $30 million of which relates to discontinued operations. We do not

anticipate that other changes to the total unrecognized tax benefits in the next twelve months will have

a significant effect on our consolidated financial statements.

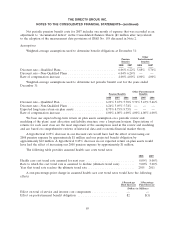

Note 10: Capital Lease Obligations

Satellite Leases

During the first quarter of 2008, Sky Brazil began broadcasting its service on a new satellite, IS 11,

pursuant to a satellite transponder capacity agreement, which we are accounting for as a capital lease.

The present value of the lease payments at the inception of the 15 year lease term was $247 million.

The capitalized value of the satellite has been included in ‘‘Satellites, net’’ in the Consolidated Balance

Sheets. The capitalized lease obligations are included in ‘‘Accounts payable and accrued liabilities’’ and

‘‘Other liabilities and deferred credits’’ in the Consolidated Balance Sheets.

During the third quarter of 2008, DTVLA amended its satellite transponder capacity agreement

for the GIIIC satellite, which provides broadcast services to PanAmericana, and was previously

classified as an operating lease. The extension of the lease term to December 2020 triggered a

reassessment of the lease classification and we determined that we should change the classification of

the amended agreement to a capital lease. The present value of the lease payments at the inception of

the lease renewal was $333 million. The capitalized value of the satellite is included in ‘‘Satellites, net’’

and the capitalized lease obligation is included in ‘‘Accounts payable and accrued liabilities’’ and ‘‘Other

liabilities and deferred credits’’ in the Consolidated Balance Sheets.

85