DIRECTV 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

Other Developments

In addition to the items described above, the following items had a significant effect on the

comparability of our operating results and financial position as of and for the years ended

December 31, 2008, 2007 and 2006:

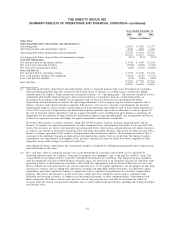

Lease Program. On March 1, 2006, DIRECTV U.S. introduced a new set-top receiver lease

program. Prior to March 1, 2006, we expensed most set-top receivers provided to new and existing

DIRECTV U.S. subscribers upon activation as a subscriber acquisition or upgrade and retention cost in

the Consolidated Statements of Operations. Subsequent to the introduction of our lease program, we

lease most set-top receivers provided to new and existing subscribers, and therefore capitalize the

set-top receivers in ‘‘Property and equipment, net’’ in the Consolidated Balance Sheets.

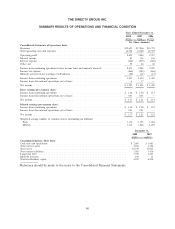

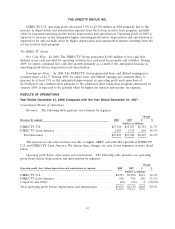

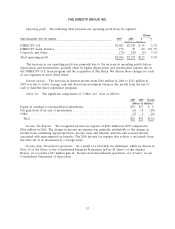

The following table sets forth the amount of DIRECTV U.S. set-top receivers we capitalized, and

depreciation expense we recorded, under the lease program for the years ended December 31:

Capitalized subscriber leased equipment: 2008 2007 2006

(Dollars in Millions)

Subscriber leased equipment—subscriber acquisitions ................. $ 599 $ 762 $ 599

Subscriber leased equipment—upgrade and retention ................. 537 774 473

Total subscriber leased equipment capitalized ....................... $1,136 $1,536 $1,072

Depreciation expense—subscriber leased equipment .................. $1,100 $ 645 $ 147

Financing Transactions. In May 2008, DIRECTV U.S. issued $1.5 billion in senior notes and

amended its senior secured credit facility to include a new $1.0 billion Term Loan C. The senior notes

bear interest at a rate of 7.625% and the principal balance is due in May 2016. The Term Loan C

currently bears interest at a rate of 5.25% and was issued at a 1% discount. Principal payments on the

Term Loan C began on September 30, 2008. The principal is payable in installments with the final

installment due in April 2013.

Share Repurchase Program. During 2006, 2007 and 2008 our Board of Directors approved multiple

authorizations for the repurchase of a total of $8.2 billion of our common stock, including a $3 billion

authorization in May 2008 that was completed in December 2008. Subsequent to December 31, 2008,

our Board of Directors authorized the repurchase of an additional $2 billion of our common stock.

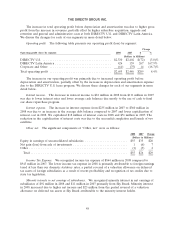

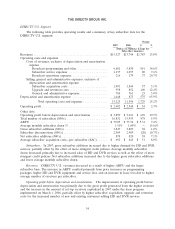

The following table sets forth information regarding shares repurchased and retired for the years

ended December 31:

2008 2007 2006

(Amounts in Millions, Except

Per Share Amounts)

Total cost of repurchased and retired shares ........................ $3,174 $2,025 $2,977

Average price per share ....................................... 24.12 23.48 16.16

Number of shares repurchased and retired ......................... 131 86 184

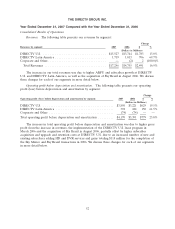

KEY TERMINOLOGY

Revenues. We earn revenues mostly from monthly fees we charge subscribers for subscriptions to

basic and premium channel programming, HD programming and access fees, pay-per-view

programming, and seasonal and live sporting events. We also earn revenues from monthly fees that we

charge subscribers with multiple non-leased set-top receivers (which we refer to as mirroring fees),

monthly fees we charge subscribers for leased set-top receivers, monthly fees we charge subscribers for

44