DIRECTV 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

willful infringement, and affirmed the earlier ruling finding several claims to be invalid prior to trial.

Following these decisions, our appeal bond was terminated and the escrowed royalties were returned to

us. In the remand now pending, initial summary judgment motions on invalidity of additional claims

have been submitted. If necessary, there will be further proceedings and a trial of remaining issues,

which is presently scheduled for October 2009.

Income Tax Matters

In 2008, we recorded a $48 million reduction to our unrecognized tax benefits as a result of the

expiration of the statute of limitations in foreign and federal taxing jurisdictions, of which $27 million

related to a previously divested business, which we included in ‘‘Income from discontinued operations,

net of taxes’’ in the Consolidated Statements of Operations.

In the second quarter of 2007, we recorded a $17 million reduction to our unrecognized tax

benefits as a result of the settlement of a foreign withholding tax dispute from a previously divested

business, which we included in ‘‘Income from discontinued operations, net of taxes’’ in the

Consolidated Statements of Operations.

We have received tax assessments from certain foreign jurisdictions and have agreed to indemnify

previously divested businesses for certain tax assessments relating to periods prior to their respective

divestitures. These assessments are in various stages of the administrative process or litigation, and we

believe we have adequately provided for any related liability.

While the outcome of these assessments and other tax issues cannot be predicted with certainty,

we believe that the ultimate outcome will not have a material effect on our consolidated financial

statements.

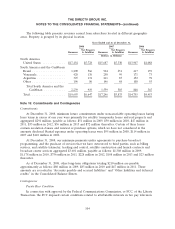

Satellites

We may purchase in-orbit and launch insurance to mitigate the potential financial impact of

satellite launch and in-orbit failures if the premium costs are considered economic relative to the risk

of satellite failure. The insurance generally covers the unamortized book value of covered satellites. We

do not insure against lost revenues in the event of a total or partial loss of the capacity of a satellite.

We generally rely on in-orbit spare satellites and excess transponder capacity at key orbital slots to

mitigate the impact a satellite failure could have on our ability to provide service. At December 31,

2008, the net book value of in-orbit satellites was $2,184 million, of which $1,978 million was uninsured.

Other

In July 2008, we amended our agreement with Thomson such that the amount of the rebate we

can earn from the purchase of set-top receivers was reduced from $57 million to $42 million and in

return, we are no longer required to purchase $4 billion in set-top receivers over the contract term. We

continue to be obligated to grant Thomson a portion of all set-top receiver purchases. As of

December 31, 2008, included in ‘‘Accounts receivable, net’’ and ‘‘Investments and other assets’’ in the

Consolidated Balance Sheets is a receivable for $21 million related to this agreement.

We are contingently liable under standby letters of credit and bonds in the aggregate amount of

$33 million at December 31, 2008.

106