DIRECTV 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

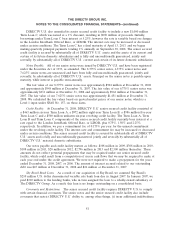

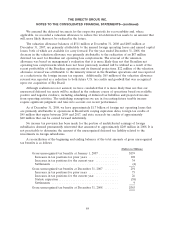

(ii) incur liens, (iii) pay dividends or make certain other restricted payments, investments or

acquisitions, (iv) enter into certain transactions with affiliates, (v) merge or consolidate with another

entity, (vi) sell, assign, lease or otherwise dispose of all or substantially all of its assets, and (vii) make

voluntary prepayments of certain debt, in each case subject to exceptions as provided in the credit

agreement and senior notes indentures. Should DIRECTV U.S. fail to comply with these covenants, all

or a portion of its borrowings under the senior notes and senior secured credit facility could become

immediately payable and its revolving credit facility could be terminated. At December 31, 2008,

DIRECTV U.S. was in compliance with all such covenants. The senior notes and senior secured credit

facility also provide that the borrowings may be required to be prepaid if certain change-in-control

events occur. In September 2008, Liberty Media became the majority owner of our outstanding

common stock. There was no ratings decline for the senior notes associated with that event, and

DIRECTV U.S. was not required either to offer to redeem any of the senior notes pursuant to their

respective indentures or to prepay any of the borrowings under the senior secured credit facility.

Restricted Cash. Restricted cash of $15 million as of December 31, 2008 and $5 million as of

December 31, 2007 was included as part of ‘‘Prepaid expenses and other’’ in our Consolidated Balance

Sheets. These amounts secure our letter of credit obligations. Restrictions on the cash will be removed

as the letters of credit expire.

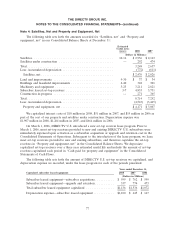

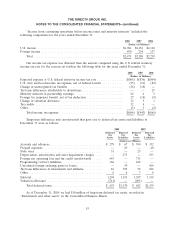

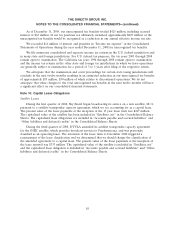

Note 9: Income Taxes

We base our income tax expense or benefit on reported ‘‘Income from continuing operations

before income taxes and minority interests.’’ Deferred income tax assets and liabilities reflect the

impact of temporary differences between the amounts of assets and liabilities recognized for financial

reporting purposes and such amounts recognized for tax purposes, as measured by applying currently

enacted tax laws.

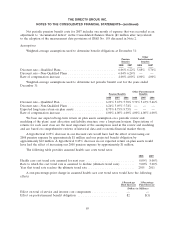

Our income tax expense consisted of the following for the years ended December 31:

2008 2007 2006

(Dollars in Millions)

Current tax expense:

U.S. federal ................................................ $(543) $(450) $ (20)

Foreign ................................................... (128) (73) (16)

State and local ............................................. (72) (103) (32)

Total ................................................... (743) (626) (68)

Deferred tax (expense) benefit:

U.S. federal ................................................ (210) (285) (704)

Foreign ................................................... 97 5 —

State and local ............................................. (8) (37) (94)

Total ................................................... (121) (317) (798)

Total income tax expense .................................... $(864) $(943) $(866)

82