DIRECTV 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

We paid cash of $96 million in 2008, $13 million in 2007 and $381 million in 2006 to acquire

interests in companies we account for under the equity method of accounting. As discussed in Note 17,

we acquired a 41% interest in Sky Mexico in 2006. The book value of our investment in Sky Mexico

was $537 million at December 31, 2008 and $505 million at December 31, 2007.

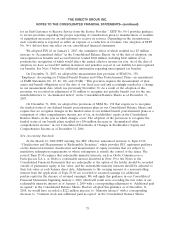

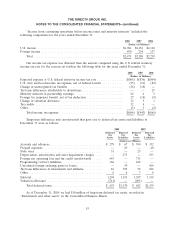

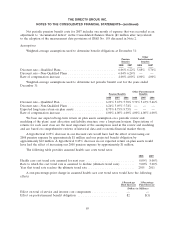

The following table sets forth equity in earnings of our 41% interest in Sky Mexico for the periods

presented:

Years Ended

December 31,

2008 2007 2006

(Dollars in

Millions)

Equity in earnings of Sky Mexico ............................... $63 $41 $18

We received cash dividends of $35 million in 2008 from companies that we account for under the

equity method.

In January 2006, we completed the sale of our 50% interest in HNS LLC to SkyTerra

Communications, Inc. and resolved a working capital adjustment from a prior transaction with SkyTerra

in exchange for $110 million in cash, which resulted in our recording a gain of $14 million related to

the sale, in addition to equity earnings of HNS LLC of $11 million in ‘‘Other, net’’ in the Consolidated

Statements of Operations.

Other Investments

We had investments in marketable equity securities of $23 million as of December 31, 2008 and

$56 million as of December 31, 2007, which were stated at current fair value and classified as

available-for-sale.

Accumulated unrealized gains, net of taxes, included as part of accumulated other comprehensive

income were $1 million in 2008, $21 million in 2007 and $9 million in 2006.

Note 7: Accounts Payable and Accrued Liabilities; Other Liabilities and Deferred Credits

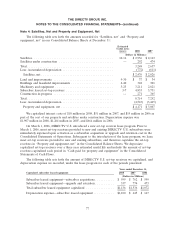

The following represent significant components of ‘‘Accounts payable and accrued liabilities’’ in our

Consolidated Balance Sheets as of December 31:

2008 2007

(Dollars in

Millions)

Programming costs ................................................. $1,640 $1,506

Accounts payable .................................................. 433 447

Property and income taxes ........................................... 161 154

Payroll and employee benefits ......................................... 165 139

Interest payable ................................................... 45 26

Other .......................................................... 671 760

Total accounts payable and accrued liabilities .......................... $3,115 $3,032

79