DIRECTV 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

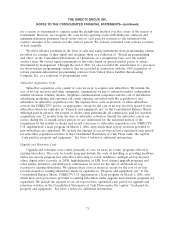

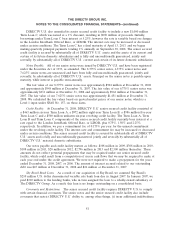

In December 2007, the FASB issued SFAS No. 160 ‘‘Noncontrolling Interests in Consolidated

Financial Statements—an amendment to ARB No. 51.’’, which establishes standards of accounting and

reporting of noncontrolling interests in subsidiaries, currently known as minority interests, in

consolidated financial statements, provides guidance on accounting for changes in the parent’s

ownership interest in a subsidiary and establishes standards of accounting of the deconsolidation of a

subsidiary due to the loss of control. SFAS No. 160 requires an entity to present minority interests as a

component of equity. Additionally, SFAS No. 160 requires an entity to present net income and

consolidated comprehensive income attributable to the parent and the minority interest separately on

the face of the Consolidated Statements of Operations. SFAS No. 160 is required to be applied

prospectively, except for the presentation and disclosure requirements, which must be applied

retrospectively for all periods presented. The adoption of SFAS No. 160 on January 1, 2009, as

required, will only affect the presentation of the minority interest in our Consolidated Statements of

Operations.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), ‘‘Business Combinations.’’ SFAS

No. 141R will require the acquiring entity to record 100% of all assets and liabilities acquired,

including goodwill and any non-controlling interest, generally at their fair values for all business

combinations, whether partial, full or step acquisitions. Under SFAS No. 141R certain contingent assets

and liabilities, as well as contingent consideration, will also be required to be recognized at fair value

on the date of acquisition and acquisition related transaction and restructuring costs will be expensed.

Additionally, SFAS No. 141R requires disclosures about the nature and financial effect of the business

combination and also changes the accounting for certain income tax assets recorded in purchase

accounting. The adoption of SFAS No. 141R as required, on January 1, 2009, will change the way we

account for adjustments to deferred tax asset valuation allowances recorded in purchase accounting for

prior business combinations and will change the accounting for all business combinations consummated

after January 1, 2009.

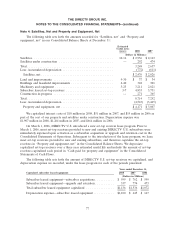

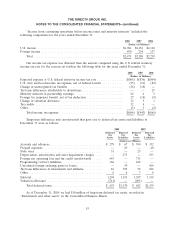

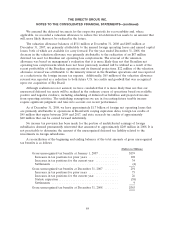

Note 3: Accounts Receivable, Net

The following table sets forth the amounts recorded for ‘‘Accounts receivable, net’’ in our

Consolidated Balance Sheets as of December 31:

2008 2007

(Dollars in

Millions)

Subscriber .......................................... $ 918 $ 925

Trade and other ...................................... 555 666

Subtotal ........................................... 1,473 1,591

Less: Allowance for doubtful accounts ..................... (50) (56)

Accounts receivable, net .............................. $1,423 $1,535

76