DIRECTV 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

resulting in an increase in goodwill of $15 million during 2008. We expect the recorded goodwill to be

deductible for tax purposes.

Darlene Transaction

On January 30, 2007, we acquired Darlene’s 14% equity interest in DLA LLC for $325 million in

cash. We accounted for the acquisition of this interest using the purchase method of accounting.

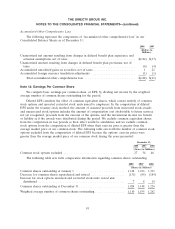

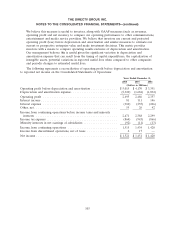

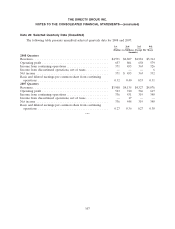

The following table set forth the final allocation of the excess purchase price over the book value

of the minority interest acquired:

Goodwill ......................................................... $187

Intangible assets .................................................... 75

Total assets acquired ................................................. 262

Net assets acquired .............................................. $262

Intangible assets that are included in ‘‘Intangible assets, net’’ in our Consolidated Balance Sheets

include a subscriber related intangible asset to be amortized over six years and a trade name intangible

asset to be amortized over 20 years from the Darlene Transaction.

Sky Transactions

During 2006 we completed the last in a series of transactions with News Corporation, Grupo

Televisa, S.A., or Televisa, Globo and Liberty Media International, which we refer to as the Sky

Transactions as further described below. The Sky Transactions resulted in the combination of the DTH

satellite platforms of DIRECTV and SKY in Latin America into a single platform in each of the major

territories in the region.

Brazil. On August 23, 2006, we completed the merger of our Brazil business, Galaxy Brasil Ltda.,

or GLB, with and into Sky Brazil, and completed the purchase of News Corporation’s and Liberty

Media International’s interests in Sky Brazil. As a result of these transactions, we hold a 74% interest

in the combined business. The purchase consideration for the transactions amounted to $670 million,

including $396 million in cash paid, of which we paid $362 million to News Corporation and Liberty

Media International in 2004 and $30 million to News Corporation in August 2006, the $64 million fair

value of the reduction of our interest in GLB resulting from the merger and the assumption of Sky

Brazil’s $210 million bank loan.

We accounted for the Sky Brazil acquisition using the purchase method of accounting, and began

consolidating the results of Sky Brazil from the date of acquisition. We also accounted for the

reduction of our interest in GLB resulting from the merger as a partial sale pursuant to EITF

No. 90-13 ‘‘Accounting for Simultaneous Common Control Mergers,’’ which resulted in us recording a

one-time pre-tax gain during the third quarter of 2006 of $61 million in ‘‘Gain from disposition of

businesses’’ in the Consolidated Statements of Operations.

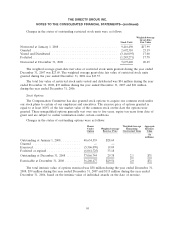

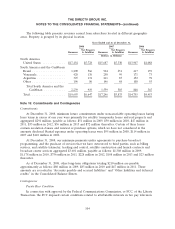

The following selected unaudited pro forma information is being provided to present a summary of

the combined results of The DIRECTV Group and Sky Brazil for the year ended December 31, 2006

as if the acquisition had occurred as of the beginning of 2006, giving effect to purchase accounting

adjustments. The pro forma data is presented for informational purposes only and may not necessarily

reflect our results of operations had Sky Brazil operated as part of us for the period presented, nor are

100