DIRECTV 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

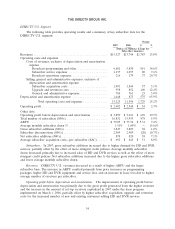

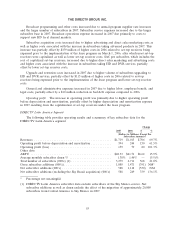

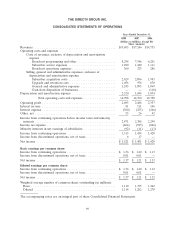

The increase in net subscriber additions, excluding the Sky Brazil acquisition in 2006, was primarily

due to subscriber growth in Brazil, Argentina, Venezuela and Colombia, as well as a decrease in churn

in Brazil and Venezuela.

The increase in revenues primarily resulted from a $527 million increase in revenue in Brazil

primarily due to the acquisition of Sky Brazil in August 2006, higher ARPU and favorable exchange

rates, as well as subscriber and ARPU growth in PanAmericana.

The higher operating profit before depreciation and amortization is primarily due to the gross

profit generated by the increase in revenues, partially offset by gains totaling $118 million for the

completion of the Sky Mexico and Sky Brazil transactions in 2006 and the increase in costs from the

addition of Sky Brazil.

The higher operating profit was primarily due to the increase in operating profit before

depreciation and amortization partially offset by higher depreciation and amortization expense resulting

from the Darlene and Sky Brazil transactions.

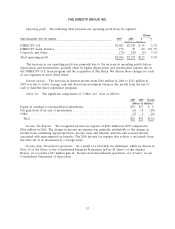

Corporate and Other

Operating loss from Corporate and Other increased to $75 million in 2007 from $70 million in

2006.

LIQUIDITY AND CAPITAL RESOURCES

Our principal sources of liquidity are our cash, cash equivalents and the cash flow that we generate

from our operations. From 2006 to 2008 we experienced significant growth in net cash provided by

operating activities and free cash flow. We expect net cash provided by operating activities and free

cash flow to continue to grow and believe that our existing cash balances and cash provided by

operations will be sufficient to fund our existing business plan. Additionally, as of December 31, 2008,

DIRECTV U.S. had the ability to borrow up to $500 million under its existing credit facility, which is

available until 2011. Borrowings under this facility may be required to fund strategic investment

opportunities should they arise.

At December 31, 2008, our cash and cash equivalents totaled $2.0 billion compared with

$1.1 billion at December 31, 2007.

As a measure of liquidity, the current ratio (ratio of current assets to current liabilities) was 1.13 at

December 31, 2008 and 0.92 at December 31, 2007. Working capital increased by $747 million to

$459 million at December 31, 2008 from working capital deficit of $288 million at December 31, 2007.

The increase during the period was mostly due to the increase in our cash and cash equivalent balances

resulting from the changes discussed below.

56