DIRECTV 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

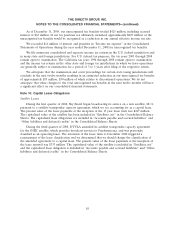

We assessed the deferred tax assets for the respective periods for recoverability and, where

applicable, we recorded a valuation allowance to reduce the total deferred tax assets to an amount that

will, more likely than not, be realized in the future.

The valuation allowance balances of $511 million at December 31, 2008 and $605 million at

December 31, 2007, are primarily attributable to the unused foreign operating losses and unused capital

losses, both of which are available for carry forward. For the year ended December 31, 2008, the

decrease in the valuation allowance was primarily attributable to the realization of an $87 million

deferred tax asset for Brazilian net operating loss carryforwards. The reversal of the valuation

allowance was based on management’s evaluation that it is more likely than not that Brazilian net

operating loss carryforwards which have not been previously realized will be utilized as a result of the

recent profitability of the Brazilian operations and its financial projections. $22 million of the valuation

allowance reversal was attributable to the minority interest in the Brazilian operations and was reported

as a reduction in the foreign income tax expense. Additionally, $65 million of the valuation allowance

reversal was reported as a reduction to both future U.S. tax credits and goodwill that was recognized

upon our acquisition of Sky Brazil.

Although realization is not assured, we have concluded that it is more likely than not that our

unreserved deferred tax assets will be realized in the ordinary course of operations based on available

positive and negative evidence, including scheduling of deferred tax liabilities and projected income

from operating activities. The underlying assumptions we use in forecasting future taxable income

require significant judgment and take into account our recent performance.

As of December 31, 2008, we have approximately $1.7 billion of foreign net operating losses that

are primarily attributable to operations in Brazil with varying expiration dates, foreign tax credits of

$45 million that expire between 2009 and 2017, and state research tax credits of approximately

$40 million that can be carried forward indefinitely.

No income tax provision has been made for the portion of undistributed earnings of foreign

subsidiaries deemed permanently reinvested that amounted to approximately $269 million in 2008. It is

not practicable to determine the amount of the unrecognized deferred tax liability related to the

investments in foreign subsidiaries.

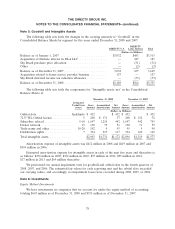

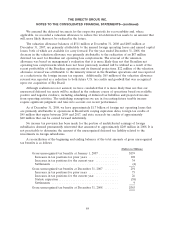

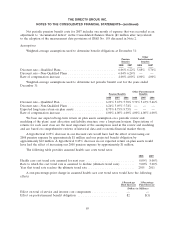

A reconciliation of the beginning and ending balances of the total amounts of gross unrecognized

tax benefits is as follows:

(Dollars in Millions)

Gross unrecognized tax benefits at January 1, 2007 ........... $159

Increases in tax positions for prior years ................. 102

Increases in tax positions for the current year ............. 34

Settlements ...................................... (4)

Gross unrecognized tax benefits at December 31, 2007 ........ 291

Increases in tax positions for prior years ................. 75

Increases in tax positions for the current year ............. 26

Statute expiration .................................. (38)

Settlements ...................................... 9

Gross unrecognized tax benefits at December 31, 2008 ........ $363

84