DIRECTV 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

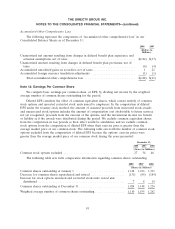

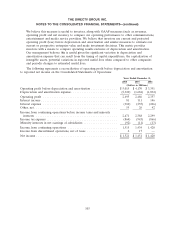

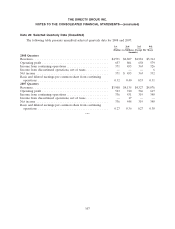

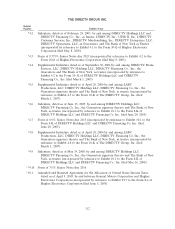

Selected information for our operating segments is reported as follows:

DIRECTV

DIRECTV Latin Corporate

U. S. America and Other Total

(Dollars in millions)

2008

Revenues ............................... $17,310 $2,383 $ — $19,693

Operating profit (loss) ..................... $ 2,330 $ 426 $ (61) $ 2,695

Add: Depreciation and amortization expense ..... 2,061 264 (5) 2,320

Operating profit (loss) before depreciation and

amortization (1) ........................ $ 4,391 $ 690 $ (66) $ 5,015

Segment assets ........................... $12,546 $3,301 $ 692 $16,539

Capital expenditures ....................... 1,765 447 17 2,229

2007

Revenues ............................... $15,527 $1,719 $ — $17,246

Operating profit (loss) ..................... $ 2,402 $ 159 $ (75) $ 2,486

Add: Depreciation and amortization expense ..... 1,448 235 1 1,684

Operating profit (loss) before depreciation and

amortization (1) ........................ $ 3,850 $ 394 $ (74) $ 4,170

Segment assets ........................... $12,297 $2,456 $ 310 $15,063

Capital expenditures ....................... 2,326 336 30 2,692

2006

Revenues ............................... $13,744 $1,013 $ (2) $14,755

Operating profit (loss) ..................... $ 2,348 $ 79 $ (70) $ 2,357

Add: Depreciation and amortization expense ..... 873 165 (4) 1,034

Operating profit (loss) before depreciation and

amortization (1) ........................ $ 3,221 $ 244 $ (74) $ 3,391

Segment assets ........................... $11,687 $2,001 $1,453 $15,141

Capital expenditures ....................... 1,798 178 — 1,976

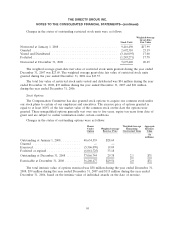

(1) Operating profit (loss) before depreciation and amortization, which is a financial measure that is

not determined in accordance with GAAP can be calculated by adding amounts under the caption

‘‘Depreciation and amortization expense’’ to ‘‘Operating profit (loss).’’ This measure should be

used in conjunction with GAAP financial measures and is not presented as an alternative measure

of operating results, as determined in accordance with GAAP. Our management and Board of

Directors use operating profit (loss) before depreciation and amortization to evaluate the

operating performance of our company and our business segments and to allocate resources and

capital to business segments. This metric is also used as a measure of performance for incentive

compensation purposes and to measure income generated from operations that could be used to

fund capital expenditures, service debt or pay taxes. Depreciation and amortization expense

primarily represents an allocation to current expense of the cost of historical capital expenditures

and for intangible assets resulting from prior business acquisitions. To compensate for the exclusion

of depreciation and amortization expense from operating profit, our management and Board of

Directors separately measure and budget for capital expenditures and business acquisitions.

102