DIRECTV 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

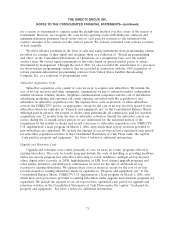

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

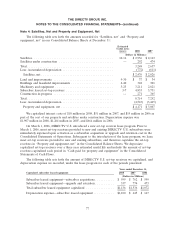

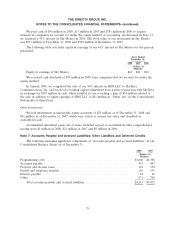

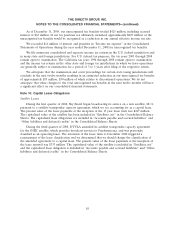

Note 4: Satellites, Net and Property and Equipment, Net

The following table sets forth the amounts recorded for ‘‘Satellites, net’’ and ‘‘Property and

equipment, net’’ in our Consolidated Balance Sheets at December 31:

Estimated

Useful Lives

(years) 2008 2007

(Dollars in Millions)

Satellites .............................................. 10-16 $ 2,956 $ 2,163

Satellites under construction ............................... — 292 474

Total ................................................. 3,248 2,637

Less: Accumulated depreciation ............................. (772) (611)

Satellites, net ......................................... $2,476 $ 2,026

Land and improvements .................................. 9-30 $ 37 $ 34

Buildings and leasehold improvements ........................ 2-40 342 301

Machinery and equipment ................................. 3-23 3,211 2,821

Subscriber leased set-top receivers ........................... 3-7 4,853 3,731

Construction in-progress .................................. — 271 365

Total ................................................. 8,714 7,252

Less: Accumulated depreciation ............................. (4,543) (3,445)

Property and equipment, net .............................. $4,171 $ 3,807

We capitalized interest costs of $18 million in 2008, $51 million in 2007, and $55 million in 2006 as

part of the cost of our property and satellites under construction. Depreciation expense was

$1,907 million in 2008, $1,264 million in 2007, and $664 million in 2006.

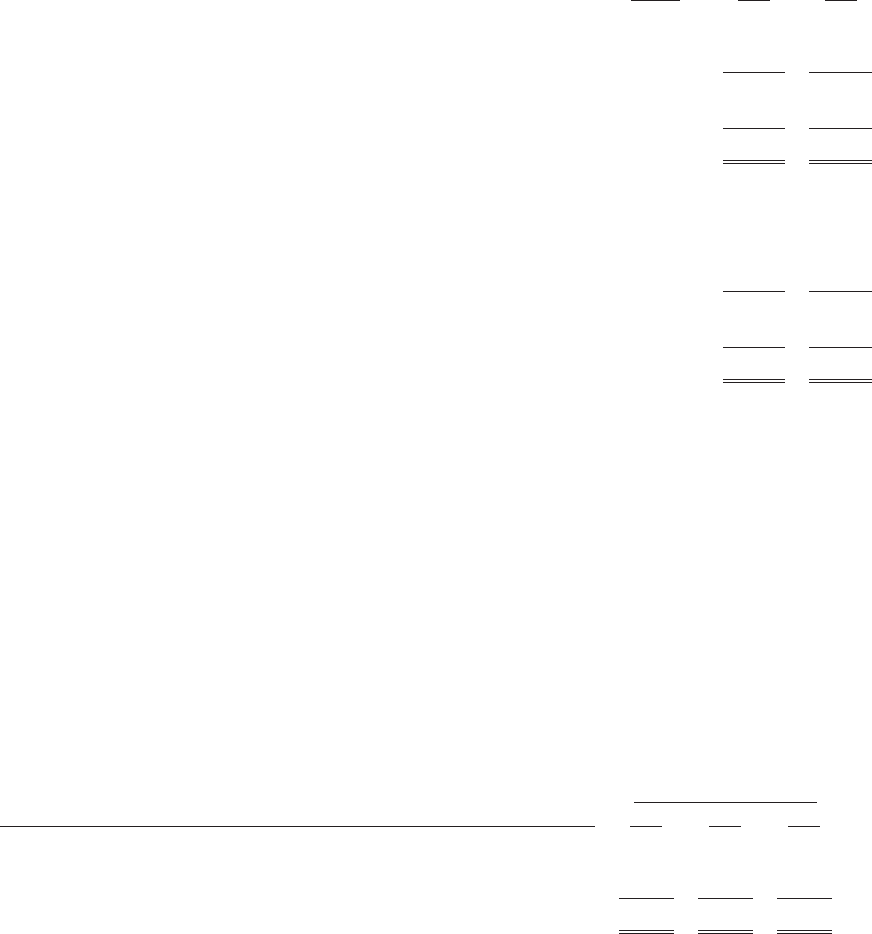

On March 1, 2006, DIRECTV U.S. introduced a new set-top receiver lease program. Prior to

March 1, 2006, most set-top receivers provided to new and existing DIRECTV U.S. subscribers were

immediately expensed upon activation as a subscriber acquisition or upgrade and retention cost in the

Consolidated Statements of Operations. Subsequent to the introduction of the lease program, we lease

most set-top receivers provided to new and existing subscribers, and therefore capitalize the set-top

receivers in ‘‘Property and equipment, net’’ in the Consolidated Balance Sheets. We depreciate

capitalized set-top receivers over a three year estimated useful life and include the amount of set-top

receivers capitalized each period in ‘‘Cash paid for property and equipment’’ in the Consolidated

Statements of Cash Flows.

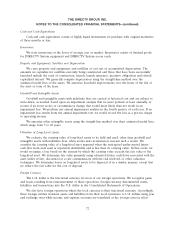

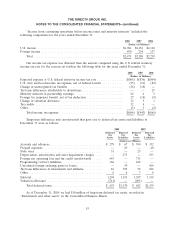

The following table sets forth the amount of DIRECTV U.S. set-top receivers we capitalized, and

depreciation expense we recorded, under the lease program for each of the periods presented:

Years ended December 31,

Capitalized subscriber leased equipment: 2008 2007 2006

(Dollars in Millions)

Subscriber leased equipment—subscriber acquisitions ........... $ 599 $ 762 $ 599

Subscriber leased equipment—upgrade and retention ........... 537 774 473

Total subscriber leased equipment capitalized ................ $1,136 $1,536 $1,072

Depreciation expense—subscriber leased equipment ............ $1,100 $ 645 $ 147

77