DIRECTV 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

voluntary prepayments of certain debt, in each case subject to exceptions as provided in the credit

agreement and senior notes indentures. Should DIRECTV U.S. fail to comply with these covenants, all

or a portion of its borrowings under the senior notes and senior secured credit facility could become

immediately payable and its revolving credit facility could be terminated. At December 31, 2008,

DIRECTV U.S. was in compliance with all such covenants and we expect to continue to be in

compliance with all covenants in 2009.

The senior notes and senior secured credit facility also provide that the borrowings may be

required to be prepaid if certain change-in-control events occur. In September 2008, Liberty Media

became the majority owner of our outstanding common stock. There was no ratings decline for the

senior notes associated with that event, and DIRECTV U.S. was not required either to offer to redeem

the senior notes pursuant to their respective indentures or to prepay any of the borrowings under the

senior secured credit facility.

Contingencies

Also, as discussed in Note 19 of the Notes to the Consolidated Financial Statements in Part II,

Item 8 of this Annual Report, Globo has the right to exchange Sky Brazil shares for cash or our

common shares. If Globo exercises this right, we have the option to elect to pay the consideration in

cash, shares of our common stock, or a combination of both.

In addition, we have approximately $97 million of cash on deposit at our Venezuelan subsidiary

that is subject to exchange controls that limit our ability to transfer the cash outside of Venezuela.

Venezuelan deposits are denominated in bolivars and translated at the official exchange rate. We are

currently required to obtain Venezuelan government approval to exchange Venezuelan bolivars into

U.S. dollars at the official rate (Bf 2,150). The approval process has been delayed in recent periods and

may be delayed further in the future. If so, our Venezuelan subsidiary may be required to rely on a

legal parallel exchange process to settle U.S. dollar obligations or to repatriate cash. If the entire

Venezuelan cash balance at December 31, 2008 had been exchanged to U.S. dollars based on the

parallel market rates, we would have recorded a charge to operating profit, and a reduction in our cash

and cash equivalents of approximately $60 million. In 2008, we recognized a charge to operating profit

of approximately $29 million in connection with the exchange of Venezuelan currency to U.S. dollars.

Several factors may affect our ability to fund our operations and commitments that we discuss in

‘‘Contractual Obligations’’, ‘‘Off-Balance Sheet Arrangements’’ and ‘‘Contingencies’’ below. In addition,

our future cash flows may be reduced if we experience, among other things, significantly higher

subscriber additions than planned, increased subscriber churn or upgrade and retention costs, higher

than planned capital expenditures for satellites and broadcast equipment, satellite anomalies or signal

theft or if we are required to make a prepayment on our term loans under DIRECTV U.S.’ senior

secured credit facility. Additionally, DIRECTV U.S.’ ability to borrow under the senior secured credit

facility is contingent upon DIRECTV U.S. meeting financial and other covenants associated with its

facility as more fully described above.

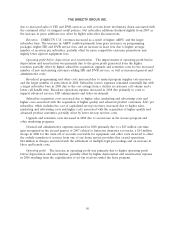

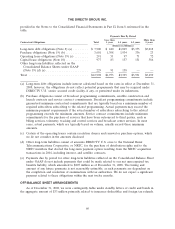

CONTRACTUAL OBLIGATIONS

The following table sets forth our contractual obligations as of December 31, 2008, including the

future periods in which payments are expected. Additional details regarding these obligations are

59