DIRECTV 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

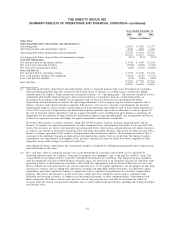

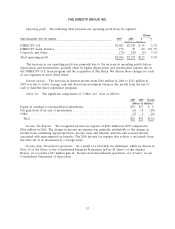

The increase in total operating profit before depreciation and amortization was due to higher gross

profit from the increase in revenues, partially offset by higher subscriber acquisition, upgrade and

retention and general and administrative costs at both DIRECTV U.S. and DIRECTV Latin America.

We discuss the changes for each of our segments in more detail below.

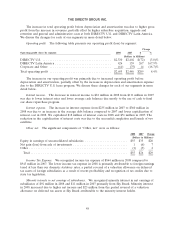

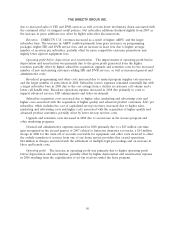

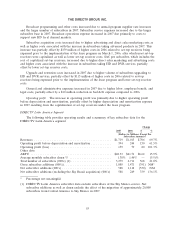

Operating profit. The following table presents our operating profit (loss) by segment:

Change

Operating profit (loss) by segment: 2008 2007 $ %

(Dollars in Millions)

DIRECTV U.S. ....................................... $2,330 $2,402 $(72) (3.0)%

DIRECTV Latin America ................................ 426 159 267 167.9%

Corporate and Other ................................... (61) (75) 14 (18.7)%

Total operating profit ................................... $2,695 $2,486 $209 8.4%

The increase in our operating profit was primarily due to increased operating profit before

depreciation and amortization, partially offset by the increase in depreciation and amortization expense

due to the DIRECTV U.S. lease program. We discuss these changes for each of our segments in more

detail below.

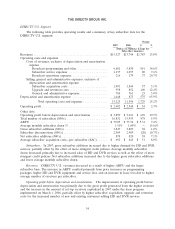

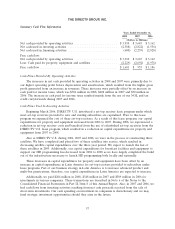

Interest income. The decrease in interest income to $81 million in 2008 from $111 million in 2007

was due to lower interest rates and lower average cash balances due mostly to the use of cash to fund

our share repurchase program.

Interest expense. The increase in interest expense from $235 million in 2007 to $360 million in

2008 was due to an increase in the average debt balance compared to 2007 and lower capitalization of

interest cost in 2008. We capitalized $18 million of interest costs in 2008 and $51 million in 2007. The

reduction in the capitalization of interest costs was due to the successful completion and launch of two

satellites.

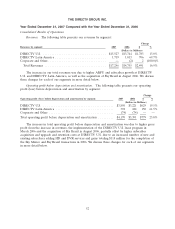

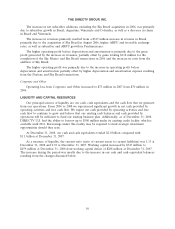

Other, net. The significant components of ‘‘Other, net’’ were as follows:

2008 2007 Change

(Dollars in Millions)

Equity in earnings of unconsolidated subsidiaries ........................ $55 $35 $20

Net gain (loss) from sale of investments ............................... 1 (6) 7

Other ........................................................ (1) (3) 2

Total ....................................................... $55 $26 $29

Income Tax Expense. We recognized income tax expense of $864 million in 2008 compared to

$943 million in 2007. The lower income tax expense in 2008 is primarily attributable to foreign earnings

taxed at less than our domestic statutory rates, a partial reversal of a valuation allowance on deferred

tax assets of foreign subsidiaries as a result of recent profitability and recognition of tax credits due to

state tax legislation.

Minority interests in net earnings of subsidiaries. We recognized minority interest in net earnings of

subsidiaries of $92 million in 2008 and $11 million in 2007 primarily from Sky Brazil. Minority interest

in 2008 increased due to higher net income and $23 million from the partial reversal of a valuation

allowance on deferred tax assets at Sky Brazil attributable to the minority interest holder.

48