DIRECTV 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock Price

Our common stock is publicly traded on The NASDAQ Global Select Market under the symbol

‘‘DTV.’’ Prior to December 3, 2007 our common stock was publicly traded on the New York Stock

Exchange, or NYSE, under the symbol ‘‘DTV.’’ The following table sets forth for the quarters indicated

the high and low sales prices for our common stock, as reported on the NYSE Composite Tape for the

period January 1, 2007 to December 2, 2007 and the NASDAQ Global Select Market for the period

December 3, 2007 to December 31, 2008.

2008 High Low

Fourth Quarter ...................................... $26.52 $17.70

Third Quarter ....................................... 28.83 23.65

Second Quarter ...................................... 29.10 24.26

First Quarter ........................................ 26.82 18.20

2007 High Low

Fourth Quarter ...................................... $27.73 $22.68

Third Quarter ....................................... 25.46 20.73

Second Quarter ...................................... 24.77 22.10

First Quarter ........................................ 26.09 21.65

As of the close of business on February 23, 2009, there were 69,856 holders of record of our

common stock.

Dividend Rights and Other Stockholder Matters

Holders of our common stock are entitled to such dividends and other distributions in cash, stock

or property as may be declared by our Board of Directors in its sole discretion, subject to the

preferential and other dividend rights of any outstanding series of our preferred stock. There were no

shares of our preferred stock outstanding at December 31, 2008.

No dividends on our common stock have been declared by our Board of Directors for more than

five years. We have no current plans to pay any dividends on our common stock. We currently expect

to use our future earnings, if any, for the development of our businesses or other corporate purposes.

DIRECTV U.S. is subject to restrictive covenants under its credit facility. These covenants limit

the ability of DIRECTV U.S. to, among other things, make restricted payments, including dividends,

loans or advances to us.

Information regarding compensation plans under which our equity securities may be issued is

included in Item 12 through incorporation by reference to our Proxy Statement for the Annual Meeting

of Stockholders scheduled to be held on June 2, 2009.

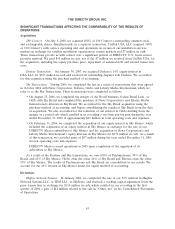

Share Repurchase Program

During 2006, 2007 and 2008 our Board of Directors approved multiple authorizations for the

repurchase of a total of $8.2 billion of our common stock, including a $3 billion authorization in May

36