DIRECTV 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

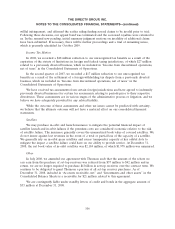

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

We accounted for the 180 Connect acquisition using the purchase method of accounting, and

began consolidating the results from the date of acquisition. The December 31, 2008 consolidated

financial statements reflect the preliminary allocation of the $91 million net purchase price to assets

acquired and the liabilities assumed based on their estimated fair values at the date of acquisition using

information currently available. The assets acquired included approximately $5 million in cash.

Amounts allocated to tangible assets, deferred tax assets and liabilities, and accrued liabilities are

estimates pending the completion of analyses currently in process. The excess of the purchase price

over the estimated fair values of the net assets acquired has been recorded as goodwill, resulting in an

increase in goodwill of $142 million during 2008. We are currently evaluating whether the recorded

goodwill will be deductible for tax purposes. The purchase price allocation is expected to be completed

during the first half of 2009.

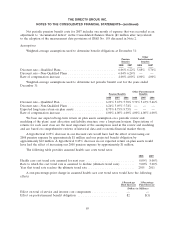

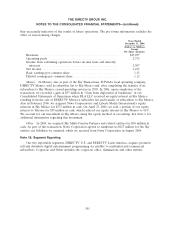

The following table sets forth the preliminary allocation of the purchase price to the 180 Connect

net assets acquired on July 8, 2008 (dollars in millions):

Total current assets .................................................. $ 21

Property and equipment .............................................. 16

Goodwill ......................................................... 142

Total assets acquired ................................................. $179

Total current liabilities ............................................... $ 80

Other liabilities .................................................... 8

Total liabilities assumed .............................................. $ 88

Net assets acquired .............................................. $ 91

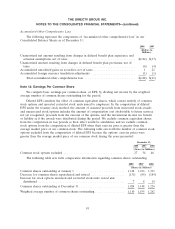

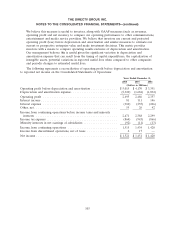

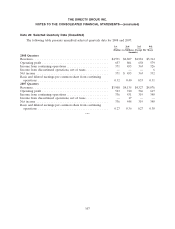

The following selected unaudited pro forma information is being provided to present a summary of

the combined results of The DIRECTV Group and 180 Connect for 2008 and 2007 as if the acquisition

had occurred as of the beginning of the respective periods, giving effect to purchase accounting

adjustments. The pro forma data is presented for informational purposes only and may not necessarily

reflect the results of our operations had 180 Connect operated as part of us for each of the periods

presented, nor are they necessarily indicative of the results of future operations. The pro forma

information excludes the effect of non-recurring charges.

Years Ended

December 31,

2008 2007

(Dollars in Millions,

Except Per Share

Amounts)

Revenues ............................................... $19,693 $17,246

Net income .............................................. 1,479 1,416

Basic and diluted earnings per common share ..................... 1.33 1.18

Other. In August 2008, we paid $11 million in cash to purchase certain assets and we assumed

certain liabilities of another home service provider for DIRECTV U.S. We accounted for the

acquisition using the purchase method of accounting, and began consolidating the results from the date

of acquisition. Amounts allocated to tangible assets, deferred tax assets and liabilities, and accrued

liabilities are estimates pending the completion of analyses currently in process. The excess of the

purchase price over the estimated fair values of the net assets acquired has been recorded as goodwill,

99