DIRECTV 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

for an End-Customer to Receive Service from the Service Provider.’’ EITF No. 06-1 provides guidance

to service providers regarding the proper reporting of consideration given to manufacturers or resellers

of equipment necessary for an end-customer to receive its services. Depending on the circumstances,

such consideration is reported as either an expense or a reduction of revenues. Our adoption of EITF

No. 06-1 did not have any effect on our consolidated financial statements.

We adopted FIN 48 on January 1, 2007, the cumulative effect of which resulted in a $5 million

increase to ‘‘Accumulated deficit’’ in the Consolidated Balance Sheets. As of the date of adoption, our

unrecognized tax benefits and accrued interest totaled $204 million, including $166 million of tax

positions the recognition of which would affect the annual effective income tax rate. As of the date of

adoption, we have accrued $45 million in interest and penalties as part of our liability for unrecognized

tax benefits. See Note 9 below for additional information regarding unrecognized tax benefits.

On December 31, 2007, we adopted the measurement date provision of SFAS No. 158,

‘‘Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans—an amendment

of FASB Statements No. 87, 88, 106, and 132(R).’’ This provision requires the measurement of plan

assets and benefit obligations as of the date of our fiscal year end and accordingly resulted in a change

in our measurement date, which was previously November 30. As a result of the adoption of this

provision, we recorded an adjustment of $1 million to recognize net periodic benefit cost for the one

month difference to ‘‘Accumulated deficit’’ in the Consolidated Balance Sheets as of December 31,

2007.

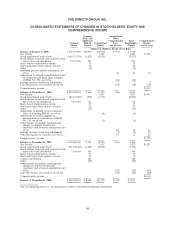

On December 31, 2006, we adopted the provisions of SFAS No. 158 that require us to recognize

the funded status of our defined benefit postretirement plans in our Consolidated Balance Sheets and

require that we recognize changes in the funded status of our defined benefit postretirement plans as a

component of other comprehensive income, net of tax, in stockholders’ equity in the Consolidated

Balance Sheets, in the year in which changes occur. The adoption of the provisions to recognize the

funded status of our benefit plans resulted in a $46 million decrease in ‘‘Accumulated other

comprehensive income’’ in our Consolidated Statements of Changes in Stockholders’ Equity and

Comprehensive Income as of December 31, 2006.

New Accounting Standards

At the March 12, 2008 EITF meeting, the SEC Observer announced revisions to Topic D-98

‘‘Classification and Measurement of Redeemable Securities’’, which provides SEC registrants guidance

on the financial statement classification and measurement of equity securities that are subject to

mandatory redemption requirements or whose redemption is outside the control of the issuer. The

revised Topic D-98 requires that redeemable minority interests, such as Globo Comunicacoes e

Participacoes S.A.’s, or Globo’s, redeemable interest described in Note 19 to the Notes to the

Consolidated Financial Statements that are redeemable at the option of the holder should be recorded

outside of permanent equity at fair value, and the redeemable minority interests should be adjusted to

their fair value at each balance sheet date. Adjustments to the carrying amount of a noncontrolling

interest from the application of Topic D-98 are recorded to retained earnings (or additional

paid-in-capital in the absence of retained earnings). We will apply this guidance in our Consolidated

Financial Statements beginning January 1, 2009, which will result in us recording the fair value of our

redeemable minority interest as of January 1, 2009 with a corresponding adjustment to ‘‘Additional paid

in capital’’ in the Consolidated Balance Sheets. Had we adopted this guidance as of December 31,

2008, we would have recorded a $222 million increase to ‘‘Minority interest’’ with a corresponding

decrease to ‘‘Common stock and additional paid-in-capital’’ in the Consolidated Balance Sheets.

75