DIRECTV 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

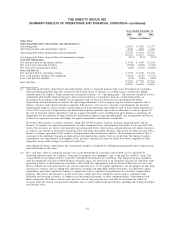

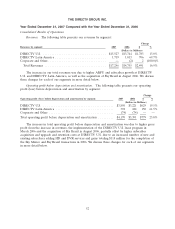

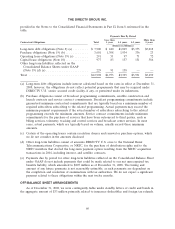

due to increased sales of HD and DVR services as well as from lower involuntary churn associated with

the continued effect of stringent credit policies. Net subscriber additions declined slightly from 2007 as

the increase in gross additions was offset by higher subscriber disconnections.

Revenues. DIRECTV U.S.’ revenues increased as a result of higher ARPU and the larger

subscriber base. The increase in ARPU resulted primarily from price increases on programming

packages, higher HD and DVR service fees, and an increase in lease fees due to higher average

number of receivers per subscriber, partially offset by more competitive customer promotions and

slightly lower upfront equipment fees.

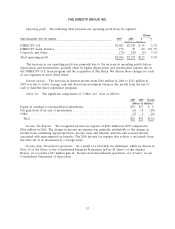

Operating profit before depreciation and amortization. The improvement of operating profit before

depreciation and amortization was primarily due to the gross profit generated from the higher

revenues, partially offset by higher subscriber acquisition, upgrade and retention costs for the increased

number of new and existing customers adding HD and DVR services, as well as increased general and

administrative costs.

Broadcast programming and other costs increased due to annual program supplier rate increases

and the larger number of subscribers in 2008. Subscriber service expenses remained essentially flat with

a larger subscriber base in 2008 due to the cost savings from a decline in customer call volume and a

lower call handle time. Broadcast operations expense increased in 2008 due primarily to costs to

support advanced services, HD enhancements and video-on-demand.

Subscriber acquisition costs increased due to higher sales, marketing and advertising costs and

higher costs associated with the acquisition of higher quality and advanced product customers. SAC per

subscriber, which includes the cost of capitalized set-top receivers, increased due to higher sales,

marketing and advertising costs and higher costs associated with the acquisition of higher quality and

advanced product customers, partially offset by lower set-top receiver costs.

Upgrade and retention costs increased in 2008 due to an increase in the movers program and

other marketing programs.

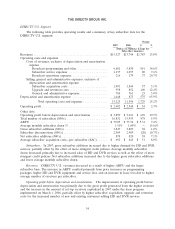

General and administrative expenses increased in 2008 primarily due to a $25 million one-time

gain recognized in the second quarter of 2007 related to hurricane insurance recoveries, a $14 million

charge in 2008 for the write-off of accounts receivable for equipment and other costs incurred to effect

the orderly transition of services from one of our home service providers that ceased operations,

$24 million in charges associated with the settlement of multiple legal proceedings and an increase in

labor and benefit costs.

Operating profit. The increase in operating profit was primarily due to higher operating profit

before depreciation and amortization, partially offset by higher depreciation and amortization expense

in 2008 resulting from the capitalization of set-top receivers under the lease program.

50