DIRECTV 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

CONTINGENCIES

For a discussion of ‘‘Contingencies’’, see Note 19 of the Notes to the Consolidated Financial

Statements in Part II, Item 8 of this Annual Report, which we incorporate herein by reference.

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

For a discussion of ‘‘Certain Relationships and Related-Party Transactions,’’ see Note 16 of the

Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report, which we

incorporate herein by reference.

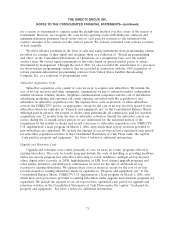

CRITICAL ACCOUNTING ESTIMATES

The preparation of the consolidated financial statements in conformity with accounting principles

generally accepted in the United States requires management to make estimates, judgments and

assumptions that affect amounts reported. Management bases its estimates, judgments and assumptions

on historical experience and on various other factors that are believed to be reasonable under the

circumstances. Due to the inherent uncertainty involved in making estimates, actual results reported for

future periods may be affected by changes in those estimates. The following represents what we believe

are the critical accounting policies that may involve a higher degree of estimation, judgment and

complexity. For a summary of our significant accounting policies, including those discussed below, see

Note 2 of the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report.

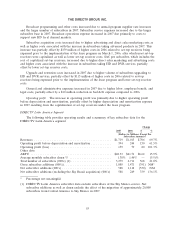

Multi-Year Programming Contracts for Live Sporting Events. We charge the cost of multi-year

programming contracts for live sporting events with minimum guarantee payments, such as DIRECTV

U.S.’ agreement with the NFL, to expense based on the ratio of each period’s contract revenues to the

estimated total contract revenues to be earned over the contract period. Management evaluates

estimated total contract revenues at least annually. Estimates of forecasted revenues rely on

assumptions regarding the number of subscribers to a given sporting events package and the estimated

package price throughout the contract. While we base our estimates on past experience and other

relevant factors, actual results could differ from our estimates. If actual results were to significantly vary

from forecasted amounts, the profit recorded on such contracts in a future period could vary from

current rates and the resulting change in profits recorded could be material to our consolidated results

of operations.

Income Taxes. We must make certain estimates and judgments in determining provisions for

income taxes. These estimates and judgments occur in the calculation of tax credits, tax benefits and

deductions, and in the calculation of certain tax assets and liabilities, which arise from differences in

the timing of recognition of revenue and expense for tax and financial statement purposes.

We assess the recoverability of deferred tax assets at each reporting date and where applicable,

record a valuation allowance to reduce the total deferred tax asset to an amount that will,

more-likely-than-not, be realized in the future. Our assessment includes an analysis of whether deferred

tax assets will be realized in the ordinary course of operations based on the available positive and

negative evidence, including the scheduling of deferred tax liabilities and forecasted income from

operating activities. The underlying assumptions we use in forecasting future taxable income require

significant judgment. In the event that actual income from operating activities differs from forecasted

amounts, or if we change our estimates of forecasted income from operating activities, we could record

additional charges in order to adjust the carrying value of deferred tax assets to their realizable

amount. Such charges could be material to our consolidated financial statements.

61