DIRECTV 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

DIRECTV U.S. also amended its senior secured credit facility to include a new $1,000 million

Term Loan C, which was issued at a 1% discount, resulting in $990 million of proceeds. Initially,

borrowings under Term Loan C bear interest at 5.25%, however the rate is variable based on changes

in the London InterBank Offered Rate, or LIBOR. The interest rate may be increased or decreased

under certain conditions. The Term Loan C has a final maturity of April 13, 2013, and we began

making quarterly principal payments totaling 1% annually on September 30, 2008. The senior secured

credit facility is secured by substantially all of DIRECTV U.S.’ assets and the assets of its current and

certain of its future domestic subsidiaries and is fully and unconditionally guaranteed, jointly and

severally, by substantially all of DIRECTV U.S.’ current and certain of its future domestic subsidiaries.

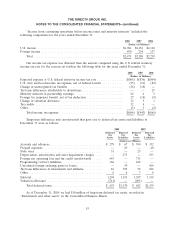

Notes Payable. All of our senior notes were issued by DIRECTV U.S. and have been registered

under the Securities Act of 1933, as amended. The 8.375% senior notes, 6.375% senior notes and

7.625% senior notes are unsecured and have been fully and unconditionally guaranteed, jointly and

severally, by substantially all of DIRECTV U.S.’ assets. Principal on the senior notes is payable upon

maturity, while interest is payable semi-annually.

The fair value of our 8.375% senior notes was approximately $904 million at December 31, 2008

and approximately $948 million at December 31, 2007. The fair value of our 6.375% senior notes was

approximately $911 million at December 31, 2008 and approximately $962 million at December 31,

2007. The fair value of our 7.625% senior notes was approximately $1,451 million at December 31,

2008. We calculated the fair values based on quoted market prices of our senior notes, which is a

Level 1 input under SFAS No. 157, on those dates.

Credit Facility. At December 31, 2008, DIRECTV U.S.’ senior secured credit facility consisted of

a $463 million six-year Term Loan A, a $972 million eight-year Term Loan B, a $986 million five-year

Term Loan C and a $500 million undrawn six-year revolving credit facility. The Term Loan A, Term

Loan B and Term Loan C components of the senior secured credit facility currently bear interest at a

rate equal to the London InterBank Offered Rate, or LIBOR, plus 0.75%, 1.50% and 2.25%,

respectively. In addition, we pay a commitment fee of 0.175% per year for the unused commitment

under the revolving credit facility. The interest rate and commitment fee may be increased or decreased

under certain conditions. The senior secured credit facility is secured by substantially all of DIRECTV

U.S.’ assets and is fully and unconditionally guaranteed, jointly and severally by substantially all of

DIRECTV U.S.’ material domestic subsidiaries.

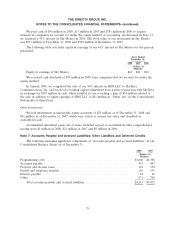

Our notes payable and credit facility mature as follows: $108 million in 2009, $308 million in 2010,

$108 million in 2011, $20 million in 2012, $2,796 million in 2013 and $2,500 million thereafter. These

amounts do not reflect potential prepayments that may be required under our senior secured credit

facility, which could result from a computation of excess cash flows that we may be required to make at

each year end under the credit agreement. We were not required to make a prepayment for the years

ended December 31, 2008, 2007, or 2006. The amount of interest accrued related to our outstanding

debt was $45 million at December 31, 2008 and $26 million at December 31, 2007.

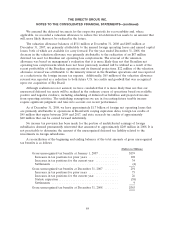

Sky Brazil Bank Loan. As a result of our acquisition of Sky Brazil, we assumed Sky Brazil’s

$210 million U.S. dollar denominated variable rate bank loan due in August 2007. In January 2007, we

paid $210 million to the lending banks, who in turn assigned the loan to a wholly-owned subsidiary of

The DIRECTV Group. As a result, this loan is no longer outstanding on a consolidated basis.

Covenants and Restrictions. The senior secured credit facility requires DIRECTV U.S. to comply

with certain financial covenants. The senior notes and the senior secured credit facility also include

covenants that restrict DIRECTV U.S.’ ability to, among other things, (i) incur additional indebtedness,

81