DIRECTV 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

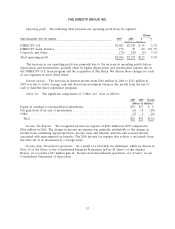

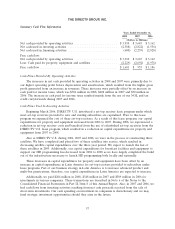

Broadcast programming and other costs increased due to annual program supplier rate increases

and the larger number of subscribers in 2007. Subscriber service expenses increased due to the larger

subscriber base in 2007. Broadcast operations expense increased in 2007 due primarily to costs to

support new HD local channel markets.

Subscriber acquisition costs increased due to higher advertising and direct sales marketing costs as

well as higher costs associated with the increase in subscribers taking advanced products in 2007. This

increase was partially offset by $159 million of higher costs in 2006 related to set-top receivers being

expensed prior to the implementation of the lease program on March 1, 2006, after which most set-top

receivers were capitalized as well as lower set-top receiver costs. SAC per subscriber, which includes the

cost of capitalized set-top receivers, increased due to higher direct sales marketing and advertising costs

and higher costs associated with the increase in subscribers taking HD and DVR services, partially

offset by lower set-top receiver costs.

Upgrade and retention costs increased in 2007 due to higher volume of subscribers upgrading to

HD and DVR services, partially offset by $115 million of higher costs in 2006 related to set-top

receivers being expensed prior to the implementation of the lease program and lower set-top receiver

costs.

General and administrative expenses increased in 2007 due to higher labor, employee benefit, and

legal costs, partially offset by a $10 million reduction in bad debt expense compared to 2006.

Operating profit. The increase in operating profit was primarily due to higher operating profit

before depreciation and amortization, partially offset by higher depreciation and amortization expense

in 2007 resulting from the capitalization of set-top receivers under the lease program.

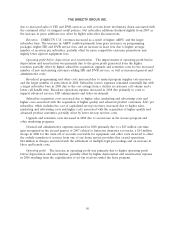

DIRECTV Latin America Segment

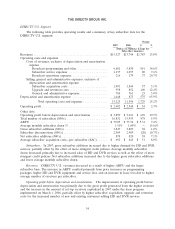

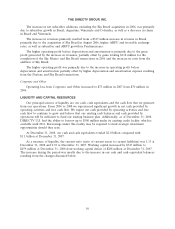

The following table provides operating results and a summary of key subscriber data for the

DIRECTV Latin America segment:

Change

2007 2006 $ %

(Dollars in Millions, Except Per

Subscriber Amounts)

Revenues ............................................ $1,719 $1,013 $ 706 69.7%

Operating profit before depreciation and amortization ............ 394 244 150 61.5%

Operating profit (loss) ................................... 159 79 80 101.3%

Other data:

ARPU .............................................. $48.33 $41.71 $6.62 15.9%

Average monthly subscriber churn % ........................ 1.38% 1.46% — (5.5)%

Total number of subscribers (000’s) (1) ....................... 3,279 2,711 568 21.0%

Gross subscriber additions (000’s) ........................... 1,080 1,471 (391) NM*

Net subscriber additions (000’s) ............................ 588 1,118 (530) NM

Net subscriber additions (excluding the Sky Brazil acquisition) (000’s) 588 249 339 136.1%

* Percentage not meaningful

(1) DIRECTV Latin America subscriber data exclude subscribers of the Sky Mexico service. Net

subscriber additions as well as churn exclude the effect of the migration of approximately 20,000

subscribers from Central America to Sky Mexico in 2007.

55