DIRECTV 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

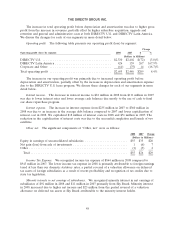

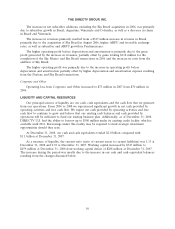

Cash Flows Used in Financing Activities

During 2006, 2007 and 2008 our Board of Directors approved, and we completed, the repurchase

of a total of $8.2 billion of our common stock as follows: $3,174 million during 2008, $2,025 million

during 2007 and $2,977 million during 2006. In January 2009, our Board of Directors authorized an

additional $2 billion of share repurchases.

Additionally, during 2008 we had $2,490 million of net cash proceeds from the issuance of senior

notes and borrowings under our senior secured credit facility which were completed in May 2008 as

described in Note 8 of the Notes to the Consolidated Financial Statements in Part II, Item 8 of this

Annual Report, and a $160 million capital contribution received in connection with the Liberty

Transaction described in Note 19 of the Notes to the Consolidated Financial Statements in Part II,

Item 8 of this Annual Report.

Free Cash Flow

Free cash flow increased in 2008 as compared to 2007 due to an increase in net cash provided by

operating activities described above, and the decrease in capital expenditures. The decrease in capital

expenditures resulted from lower set-top receiver costs for set-top receivers capitalized under the

DIRECTV U.S. lease program and lower capital expenditures for satellite and broadcast facilities and

equipment to support HD programming partially offset by increased capital expenditures in Latin

America.

Free cash flow decreased in 2007 compared to 2006 as the increase in net cash provided by

operating activities discussed above was more than offset by an increase in capital expenditures for

leased set-top receivers. Capital expenditures for leased set-top receivers increased as a result of an

increase in the amount of set-top receivers capitalized in 2007 under the DIRECTV U.S. lease

program implemented in March 2006.

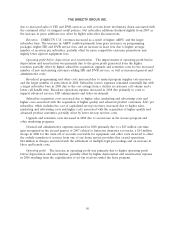

During 2009, we expect continued free cash flow growth primarily as a result of the anticipated

increase in operating profit before depreciation and amortization.

Debt

At December 31, 2008, we had $5,833 million in total outstanding borrowings, bearing a weighted

average interest rate of 5.7%. Our outstanding borrowings primarily consist of notes payable and

amounts borrowed under a senior secured credit facility of DIRECTV U.S. as more fully described in

Note 8 of the Notes to the Consolidated Financial Statements in Item 8, Part II of this Annual Report,

which we incorporate herein by reference.

Our notes payable and senior secured credit facility and other borrowings mature as follows:

$108 million in 2009; $308 million in 2010; $108 million in 2011; $20 million in 2012; $2,796 million in

2013; and $2,500 million thereafter. However, these amounts do not reflect potential prepayments that

may be required under DIRECTV U.S.’ senior secured credit facility, which could result from a

computation that we are required to make each year end under the credit agreement. We were not

required to make a prepayment for the years ended December 31, 2008 and 2007.

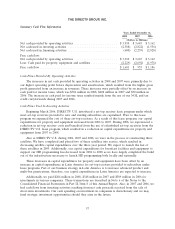

Covenants and Restrictions. The senior secured credit facility requires DIRECTV U.S. to comply

with certain financial covenants. The senior notes and the senior secured credit facility also include

covenants that restrict DIRECTV U.S.’ ability to, among other things, (i) incur additional indebtedness,

(ii) incur liens, (iii) pay dividends or make certain other restricted payments, investments or

acquisitions, (iv) enter into certain transactions with affiliates, (v) merge or consolidate with another

entity, (vi) sell, assign, lease or otherwise dispose of all or substantially all of its assets, and (vii) make

58