Cisco 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

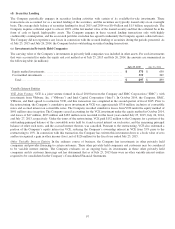

Pending Divestiture On July 22, 2015, the Company entered into an exclusive agreement to sell the client premises equipment

portion of its Service Provider Video connected devices business unit to French-based Technicolor for approximately

$600 million in cash and stock subject to certain adjustments provided for in the agreement. In connection with this transaction,

the Company had tangible assets of approximately $190 million which were held for sale (of which the most significant

component is inventories of approximately $160 million), and current liabilities of approximately $125 million (primarily

comprised of supply chain-related liabilities, warranties, rebates and other accrued liabilities), which were held for sale. The

Company estimates that approximately $150 million of goodwill is attributable to this business, based on its relative fair value.

The Company expects the transaction to close at the end of the second quarter of fiscal 2016, subject to customary closing

conditions, including regulatory approvals.

(c) Other Acquisition and Divestiture Information

Total transaction costs related to the Company’s acquisitions during fiscal 2015, 2014, and 2013 were $10 million, $7 million,

and $40 million, respectively. These transaction costs were expensed as incurred in general and administrative (G&A) expenses

in the Consolidated Statements of Operations.

The Company’s purchase price allocation for acquisitions completed during recent periods are preliminary and subject to revision

as additional information about fair value of assets and liabilities becomes available. Additional information, which existed as of

the acquisition date but at that time was unknown to the Company, may become known to the Company during the remainder of

the measurement period, a period not to exceed 12 months from the acquisition date. Adjustments in the purchase price allocation

may require a recasting of the amounts allocated to goodwill retroactive to the period in which the acquisition occurred.

The goodwill generated from the Company’s acquisitions completed during fiscal 2015 is primarily related to expected synergies.

The goodwill is generally not deductible for income tax purposes.

The Consolidated Financial Statements include the operating results of each acquisition from the date of acquisition. Pro forma

results of operations for the acquisitions completed during the fiscal years presented have not been presented because the effects

of the acquisitions, individually and in the aggregate, were not material to the Company’s financial results.

During the third quarter of fiscal 2013, the Company completed the sale of its Linksys product line to a third party. The financial

statement impact of the Company’s Linksys product line and its resulting sale were not material for any of the fiscal years

presented.

87