Cisco 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

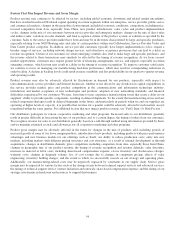

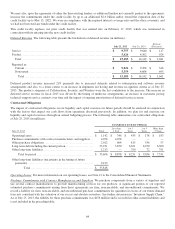

Financing Receivables and Guarantees We measure our net balance sheet exposure position related to our financing receivables

and financing guarantees by reducing the total of gross financing receivables and financing guarantees by the associated

allowances for credit loss and deferred revenue. As of July 25, 2015, our net balance sheet exposure position related to financing

receivables and financing guarantees was as follows (in millions):

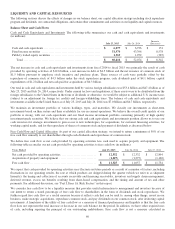

FINANCING RECEIVABLES FINANCING GUARANTEES

July 25, 2015

Lease

Receivables

Loan

Receivables

Financed

Service

Contracts

and Other Total

Channel

Partner

End-User

Customers Total TOTAL

Financing receivables and

guarantees ........................ $ 3,395 $ 1,763 $ 3,573 $ 8,731 $ 288 $ 129 $ 417 $ 9,148

Allowance for credit loss .......... (259) (87) (36) (382) — — — (382)

Deferred revenue ................. (5) (13) (1,853) (1,871) (127) (107) (234) (2,105)

Net balance sheet exposure . . . $ 3,131 $ 1,663 $ 1,684 $ 6,478 $ 161 $ 22 $ 183 $ 6,661

Financing Receivables Financing receivables less unearned income increased by 4% compared with the end of fiscal 2014. The

change was primarily due to an 11% increase in financed service contracts and other, and a 5% increase in loan receivables,

partially offset by a 4% decrease in lease receivables. We provide financing to certain end-user customers and channel partners to

enable sales of our products, services, and networking solutions. These financing arrangements include leases, financed service

contracts, and loans. Arrangements related to leases are generally collateralized by a security interest in the underlying assets.

Lease receivables include sales-type and direct-financing leases. We also provide certain qualified customers financing for long-

term service contracts, which primarily relate to technical support services. Our loan financing arrangements may include not

only financing the acquisition of our products and services but also providing additional funds for other costs associated with

network installation and integration of our products and services. We expect to continue to expand the use of our financing

programs in the near term.

Financing Guarantees In the normal course of business, third parties may provide financing arrangements to our customers and

channel partners under financing programs. The financing arrangements to customers provided by third parties are related to

leases and loans and typically have terms of up to three years. In some cases, we provide guarantees to third parties for these lease

and loan arrangements. The financing arrangements to channel partners consist of revolving short-term financing provided by

third parties, generally with payment terms ranging from 60 to 90 days. In certain instances, these financing arrangements result

in a transfer of our receivables to the third party. The receivables are derecognized upon transfer, as these transfers qualify as true

sales, and we receive payments for the receivables from the third party based on our standard payment terms. The volume of

channel partner financing was $25.9 billion, $24.6 billion, and $23.8 billion in fiscal 2015, 2014, and 2013, respectively. These

financing arrangements facilitate the working capital requirements of the channel partners, and in some cases, we guarantee a

portion of these arrangements. The balance of the channel partner financing subject to guarantees was $1.2 billion as of each of

July 25, 2015 and July 26, 2014. We could be called upon to make payments under these guarantees in the event of nonpayment

by the channel partners or end-user customers. Historically, our payments under these arrangements have been immaterial. Where

we provide a guarantee, we defer the revenue associated with the channel partner and end-user financing arrangement in

accordance with revenue recognition policies, or we record a liability for the fair value of the guarantees. In either case, the

deferred revenue is recognized as revenue when the guarantee is removed.

Deferred Revenue Related to Financing Receivables and Guarantees The majority of the deferred revenue in the preceding table

is related to financed service contracts. The majority of the revenue related to financed service contracts, which primarily relates

to technical support services, is deferred as the revenue related to financed service contracts is recognized ratably over the period

during which the related services are to be performed. A portion of the revenue related to lease and loan receivables is also

deferred and included in deferred product revenue based on revenue recognition criteria not currently having been met.

62