Cisco 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or end-user customers. Deferred revenue relating to these financing arrangements is recorded in accordance with revenue

recognition policies or for the fair value of the financing guarantees.

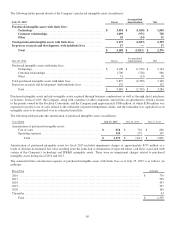

(g) Depreciation and Amortization Property and equipment are stated at cost, less accumulated depreciation or amortization,

whenever applicable. Depreciation and amortization expenses for property and equipment were approximately $1.1 billion, $1.2

billion, and $1.2 billion for fiscal 2015, 2014, and 2013, respectively. Depreciation and amortization are computed using the

straight-line method, generally over the following periods:

Asset Category Period

Buildings ...................................................... 25years

Building improvements ........................................ 10 years

Leasehold improvements ...................................... Shorter of remaining lease term or up to 10 years

Computer equipment and related software ..................... 30to 36months

Production, engineering, and other equipment .................. Upto 5years

Operating lease assets ......................................... Based on lease term

Furniture and fixtures .......................................... 5years

(h) Business Combinations The Company allocates the fair value of the purchase consideration of its acquisitions to the tangible

assets, liabilities, and intangible assets acquired, including in-process research and development (IPR&D), based on their

estimated fair values. The excess of the fair value of purchase consideration over the fair values of these identifiable assets and

liabilities is recorded as goodwill. IPR&D is initially capitalized at fair value as an intangible asset with an indefinite life and

assessed for impairment thereafter. When an IPR&D project is completed, the IPR&D is reclassified as an amortizable purchased

intangible asset and amortized over the asset’s estimated useful life. Acquisition-related expenses and related restructuring costs

are recognized separately from the business combination and are expensed as incurred.

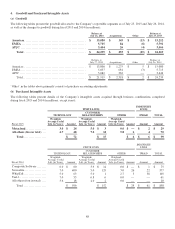

(i) Goodwill and Purchased Intangible Assets Goodwill is tested for impairment on an annual basis in the fourth fiscal quarter

and, when specific circumstances dictate, between annual tests. When impaired, the carrying value of goodwill is written down to

fair value. The goodwill impairment test involves a two-step process. The first step, identifying a potential impairment, compares

the fair value of a reporting unit with its carrying amount, including goodwill. If the carrying value of the reporting unit exceeds

its fair value, the second step would need to be conducted; otherwise, no further steps are necessary as no potential impairment

exists. If necessary, the second step to measure the impairment loss would be to compare the implied fair value of the reporting

unit goodwill with the carrying amount of that goodwill. Any excess of the reporting unit goodwill carrying value over the

respective implied fair value is recognized as an impairment loss. Purchased intangible assets with finite lives are carried at cost,

less accumulated amortization. Amortization is computed over the estimated useful lives of the respective assets. See “Long-

Lived Assets” for the Company’s policy regarding impairment testing of purchased intangible assets with finite lives. Purchased

intangible assets with indefinite lives are assessed for potential impairment annually or when events or circumstances indicate

that their carrying amounts might be impaired.

(j) Long-Lived Assets Long-lived assets that are held and used by the Company are reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Determination of

recoverability of long-lived assets is based on an estimate of the undiscounted future cash flows resulting from the use of the asset

and its eventual disposition. Measurement of an impairment loss for long-lived assets that management expects to hold and use is

based on the difference between the fair value of the asset and its carrying value. Long-lived assets to be disposed of are reported

at the lower of carrying amount or fair value less costs to sell.

(k) Fair Value Fair value is defined as the price that would be received from selling an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. When determining the fair value measurements for

assets and liabilities required or permitted to be either recorded or disclosed at fair value, the Company considers the principal or

most advantageous market in which it would transact, and it also considers assumptions that market participants would use when

pricing the asset or liability.

The accounting guidance for fair value measurement requires an entity to maximize the use of observable inputs and minimize

the use of unobservable inputs when measuring fair value. The standard establishes a fair value hierarchy based on the level of

independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within

the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. The fair value

hierarchy is as follows:

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or

liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in

80