Cisco 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Effect of Foreign Currency

In fiscal 2015, foreign currency fluctuations, net of hedging, decreased the combined R&D, sales and marketing, and G&A

expenses by approximately $278 million, or 1.6%, compared with fiscal 2014. In fiscal 2014, foreign currency fluctuations, net of

hedging, decreased the combined R&D, sales and marketing, and G&A expenses by approximately $153 million, or 0.9%,

compared with fiscal 2013.

Headcount

Fiscal 2015 Compared with Fiscal 2014

The decrease in headcount of approximately 2,200 employees in fiscal 2015 was due to headcount reductions from attrition and

from our restructuring plan announced in August 2014. These headcount reductions were partially offset by headcount additions

from targeted hiring in engineering and services, and also by headcount additions from our recent acquisitions.

Fiscal 2014 Compared with Fiscal 2013

Our headcount decreased by approximately 1,000 employees in fiscal 2014. The decrease was due to headcount reductions from

attrition and from our workforce reduction plan announced in August 2013. These headcount reductions were partially offset by

the increase in headcount from targeted hiring in engineering, services, sales, and also by increased headcount from our recent

acquisitions.

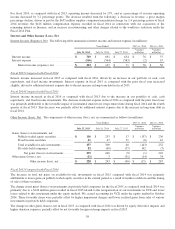

Share-Based Compensation Expense

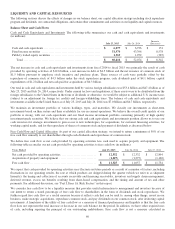

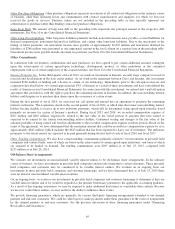

The following table presents share-based compensation expense (in millions):

Years Ended July 25, 2015 July 26, 2014 July 27, 2013

Cost of sales—product ......................................................... $50$45$40

Cost of sales—service .......................................................... 157 150 138

Share-based compensation expense in cost of sales .............................. 207 195 178

Research and development ..................................................... 448 411 286

Sales and marketing ............................................................ 559 549 484

General and administrative ..................................................... 228 198 175

Restructuring and other charges ................................................. (2) (5) (3)

Share-based compensation expense in operating expenses ....................... 1,233 1,153 942

Total share-based compensation expense ....................................... $ 1,440 $ 1,348 $ 1,120

The increase in share-based compensation expense for fiscal 2015, as compared with fiscal 2014, was due primarily to higher

expense associated with performance-based restricted stock units and charges associated with severance arrangements with

certain executives, partially offset by lower expense related to equity awards assumed with respect to our recent acquisitions.

The increase in share-based compensation expense for fiscal 2014, as compared with fiscal 2013, was due primarily to

share-based compensation expense attributable to equity awards assumed with respect to our recent acquisitions and higher

forfeiture credits in fiscal 2013.

56