Cisco 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

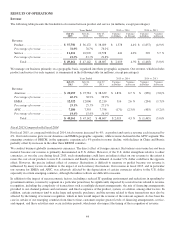

Fourth Quarter Snapshot

For the fourth quarter of fiscal 2015, as compared with the corresponding period in fiscal 2014, total revenue grew 4%, as product

and service revenue each increased by 4%. With regard to our geographic segment performance, on a year-over-year basis

revenue in the Americas increased by 7%, while EMEA and APJC were both flat. From a product category perspective, product

revenue growth was driven by growth from Collaboration and Data Center products, as each grew 14% year over year. Total

gross margin increased by 0.3 percentage points. As a percentage of revenue, research and development, sales and marketing, and

general and administrative expenses collectively decreased by 0.9 percentage points. Operating income as a percentage of

revenue increased by 0.7 percentage points. Diluted earnings per share increased by 5% from the prior year, primarily as a result

of both a 3% increase in net income and a decrease in our diluted share count by 41 million shares.

Strategy and Focus Areas

We see our customers, in every industry, increasingly using technology—and, specifically, the network—to grow their business,

drive efficiencies, and try to gain a competitive advantage. In this increasingly digital world, data is the most strategic asset and is

increasingly distributed across every organization and ecosystem—on customer premises, at the edge of the network, and in the

cloud. The network also plays an increasingly important role enabling our customers to aggregate, automate, and draw insights

from this highly distributed data where there is a premium on security and speed. This is driving them to adopt entirely new IT

architectures and organizational structures. We understand how technology can deliver the outcomes our customers want to

achieve, and our strategy is to lead our customers in their digital transition with solutions including pervasive, industry-leading

security that intelligently connect nearly everything that can be connected.

To deliver on our strategy, we are focused on providing highly secure, automated and intelligent solutions built on infrastructure

that connects data that is highly distributed (globally dispersed across organizations). Together with our ecosystem of partners

and developers, we aim to provide the technology, services, and solutions that we believe will enable our customers to gain

insight and advantage from this distributed data with scale, security and agility.

For a full discussion of our strategy and focus areas, see Item 1. Business.

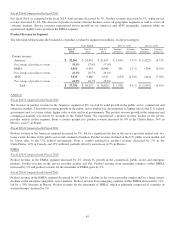

Other Key Financial Measures

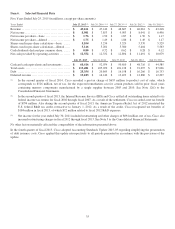

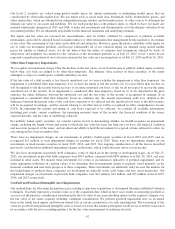

The following is a summary of our other key financial measures for fiscal 2015 compared with fiscal 2014 (in millions, except

days sales outstanding in accounts receivable (DSO) and annualized inventory turns):

Fiscal 2015 Fiscal 2014

Cash and cash equivalents and investments ............................................... $ 60,416 $ 52,074

Cash provided by operating activities ..................................................... $ 12,552 $ 12,332

Deferred revenue ......................................................................... $ 15,183 $ 14,142

Repurchases of common stock—stock repurchase program ............................... $ 4,234 $ 9,539

Dividends ................................................................................ $ 4,086 $ 3,758

DSO ..................................................................................... 38 days 38 days

Inventories ............................................................................... $ 1,627 $ 1,591

Annualized inventory turns ............................................................... 12.1 12.7

Our product backlog at the end of fiscal 2015 was $5.1 billion, or 10% of fiscal 2015 total revenue, compared with $5.4 billion at

the end of fiscal 2014, or 12% of fiscal 2014 total revenue.

38