Cisco 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

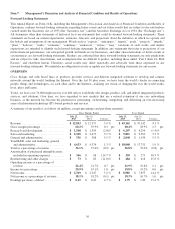

Fiscal 2014 Compared with Fiscal 2013

For fiscal 2014, as compared with fiscal 2013, total revenue decreased by 3%. Product revenue decreased by 5%, while service

revenue increased by 4%. The decrease in product revenue reflected declines across all geographic segments as well as across all

customer markets. Service revenues experienced slower growth in our Americas and APJC geographic segments while we

experienced slightly faster growth in the EMEA segment.

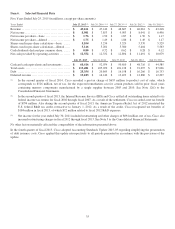

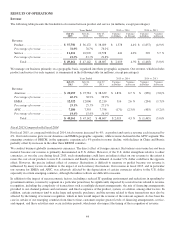

Product Revenue by Segment

The following table presents the breakdown of product revenue by segment (in millions, except percentages):

Years Ended 2015 vs. 2014 2014 vs. 2013

July 25,

2015

July 26,

2014

July 27,

2013

Variance

in Dollars

Variance

in Percent

Variance

in Dollars

Variance

in Percent

Product revenue:

Americas .............................. $ 22,261 $ 20,631 $ 21,653 $ 1,630 7.9 % $ (1,022) (4.7)%

Percentage of product revenue ........ 59.0% 57.0% 57.0%

EMEA ................................ 9,856 9,655 10,049 201 2.1 % (394) (3.9)%

Percentage of product revenue ........ 26.1% 26.7% 26.4%

APJC ................................. 5,633 5,886 6,327 (253) (4.3)% (441) (7.0)%

Percentage of product revenue ........ 14.9% 16.3% 16.6%

Total .............................. $ 37,750 $ 36,172 $ 38,029 $ 1,578 4.4 % $ (1,857) (4.9)%

Americas

Fiscal 2015 Compared with Fiscal 2014

The increase in product revenue in the Americas segment of 8% was led by solid growth in the public sector, commercial and

enterprise markets. The product revenue growth in the public sector market was due primarily to higher sales to the U.S. federal

government and, to a lesser extent, higher sales to state and local governments. The product revenue growth in the enterprise and

commercial markets was driven by strength in the United States. We experienced a product revenue decline in the service

provider market in this segment. From a country perspective, product revenue increased by 8% in the United States, 34% in

Mexico, and 2% in Brazil.

Fiscal 2014 Compared with Fiscal 2013

Product revenue in the Americas segment decreased by 5%, led by a significant decline in the service provider market and, to a

lesser extent, declines in the public sector and commercial markets. Product revenue declined in the U.S. public sector market, led

by lower sales to the U.S. federal government. From a country perspective, product revenue decreased by 5% in the

United States, 10% in Canada, and 13% in Brazil, partially offset by an increase of 2% in Mexico.

EMEA

Fiscal 2015 Compared with Fiscal 2014

Product revenue in the EMEA segment increased by 2%, driven by growth in the commercial, public sector and enterprise

markets. Product revenue in the service provider market was flat. Product revenue from emerging countries within EMEA

increased by 1% and product revenue for the remainder of EMEA grew by 2%.

Fiscal 2014 Compared with Fiscal 2013

Product revenue in the EMEA segment decreased by 4%, led by a decline in the service provider market and, to a lesser extent,

declines in the enterprise and public sector markets. Product revenue from emerging countries within EMEA decreased by 11%,

led by a 24% decrease in Russia. Product revenue for the remainder of EMEA, which is primarily composed of countries in

western Europe, declined by 2%.

45