Cisco 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

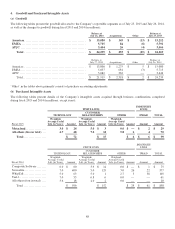

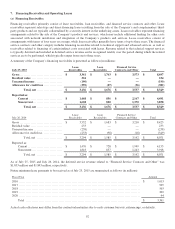

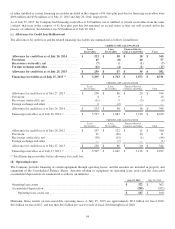

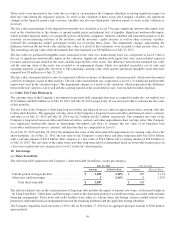

(b) Credit Quality of Financing Receivables

Gross receivables less unearned income categorized by the Company’s internal credit risk rating as of July 25, 2015 and July 26,

2014 are summarized as follows (in millions):

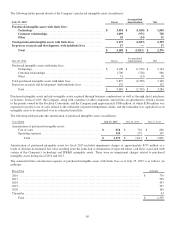

INTERNAL CREDIT RISK RATING

July 25, 2015 1to4 5to6 7 and Higher Total

Lease receivables ............................................... $ 1,688 $ 1,342 $ 141 $ 3,171

Loan receivables ................................................ 788 823 152 1,763

Financed service contracts and other .......................... 2,133 1,389 51 3,573

Total ......................................................... $ 4,609 $ 3,554 $ 344 $ 8,507

INTERNAL CREDIT RISK RATING

July 26, 2014 1to4 5to6 7 and Higher Total

Lease receivables ................................................ $ 1,615 $ 1,538 $ 141 $ 3,294

Loan receivables ................................................. 953 593 137 1,683

Financed service contracts and other ............................. 1,744 1,367 99 3,210

Total .......................................................... $ 4,312 $ 3,498 $ 377 $ 8,187

The Company determines the adequacy of its allowance for credit loss by assessing the risks and losses inherent in its financing

receivables by portfolio segment. The portfolio segment is based on the types of financing offered by the Company to its

customers, which consist of the following: lease receivables, loan receivables, and financed service contracts and other.

The Company’s internal credit risk ratings of 1 through 4 correspond to investment-grade ratings, while credit risk ratings of 5

and 6 correspond to non-investment grade ratings. Credit risk ratings of 7 and higher correspond to substandard ratings.

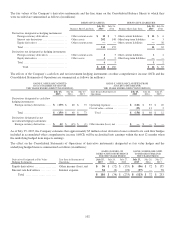

In circumstances when collectibility is not deemed reasonably assured, the associated revenue is deferred in accordance with the

Company’s revenue recognition policies, and the related allowance for credit loss, if any, is included in deferred revenue. The

Company also records deferred revenue associated with financing receivables when there are remaining performance obligations,

as it does for financed service contracts. Total allowances for credit loss and deferred revenue as of July 25, 2015 and July 26,

2014 were $2,253 million and $2,220 million, respectively, and they were associated with total financing receivables before

allowance for credit loss of $8,731 million and $8,420 million as of their respective period ends.

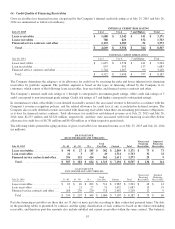

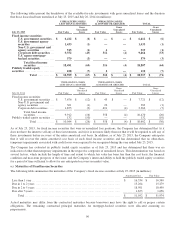

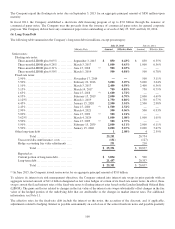

The following tables present the aging analysis of gross receivables less unearned income as of July 25, 2015 and July 26, 2014

(in millions):

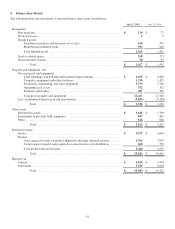

DAYS PAST DUE

(INCLUDES BILLED AND UNBILLED)

July 25, 2015 31 - 60 61 - 90 91+

Total

Past Due Current Total

Nonaccrual

Financing

Receivables

Impaired

Financing

Receivables

Lease receivables ...................... $ 90 $ 27 $ 185 $ 302 $ 2,869 $ 3,171 $ 73 $ 73

Loan receivables ...................... 21 3 25 49 1,714 1,763 32 32

Financed service contracts and other .. 396 152 414 962 2,611 3,573 29 9

Total ................................ $ 507 $ 182 $ 624 $ 1,313 $ 7,194 $ 8,507 $ 134 $ 114

DAYS PAST DUE

(INCLUDES BILLED AND UNBILLED)

July 26, 2014 31 - 60 61 - 90 91+

Total

Past Due Current Total

Nonaccrual

Financing

Receivables

Impaired

Financing

Receivables

Lease receivables ....................... $ 63 $ 46 $ 202 $ 311 $ 2,983 $ 3,294 $ 48 $ 41

Loan receivables ....................... 3 21 27 51 1,632 1,683 19 19

Financed service contracts and other .... 268 230 220 718 2,492 3,210 12 9

Total ................................ $ 334 $ 297 $ 449 $ 1,080 $ 7,107 $ 8,187 $ 79 $ 69

Past due financing receivables are those that are 31 days or more past due according to their contractual payment terms. The data

in the preceding tables is presented by contract, and the aging classification of each contract is based on the oldest outstanding

receivable, and therefore past due amounts also include unbilled and current receivables within the same contract. The balances

93