Cisco 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

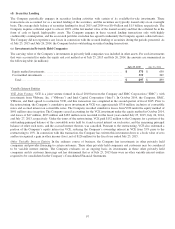

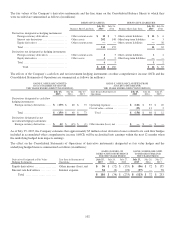

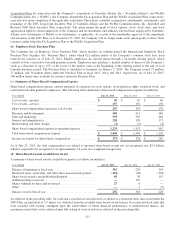

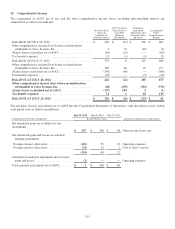

Financing Guarantee Summary The aggregate amounts of financing guarantees outstanding at July 25, 2015 and July 26, 2014,

representing the total maximum potential future payments under financing arrangements with third parties along with the related

deferred revenue, are summarized in the following table (in millions):

July 25, 2015 July 26, 2014

Maximum potential future payments relating to financing guarantees:

Channel partner ...................................................................... $ 288 $ 263

End user ............................................................................. 129 202

Total ............................................................................ $ 417 $ 465

Deferred revenue associated with financing guarantees:

Channel partner ...................................................................... $ (127) $ (127)

End user ............................................................................. (107) (166)

Total ............................................................................ $ (234) $ (293)

Maximum potential future payments relating to financing guarantees, net of associated

deferred revenue .......................................................................... $ 183 $ 172

Other Guarantees The Company’s other guarantee arrangements as of July 25, 2015 and July 26, 2014 that were subject to

recognition and disclosure requirements were not material.

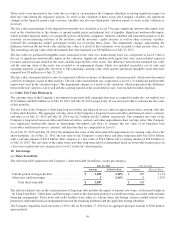

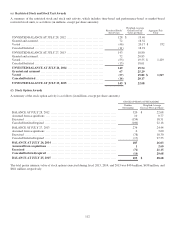

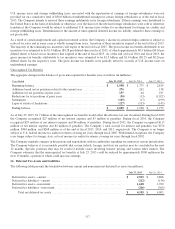

(f) Supplier Component Remediation Liability

The Company has recorded in other current liabilities a liability for the expected remediation cost for certain products sold in

prior fiscal years containing memory components manufactured by a single supplier between 2005 and 2010. These components

were widely used across the industry and are included in a number of the Company’s products. Defects in some of these

components have caused products to fail after a power cycle event. Defect rates due to this issue have been and are expected to be

low. However, the Company has seen a small number of its customers experience a growing number of failures in their networks

as a result of this component problem. Although the majority of these products was beyond the Company’s warranty terms, the

Company has been proactively working with customers on mitigation. Prior to the second quarter of fiscal 2014, the Company

had a liability of $63 million related to this issue for expected remediation costs based on the intended approach at that time. In

February 2014, on the basis of the growing number of failures described above, the Company decided to expand its approach,

which resulted in a charge to product cost of sales of $655 million being recorded for the second quarter of fiscal 2014. During

the third quarter of fiscal 2015, an adjustment to product cost of sales of $164 million was recorded to reduce the liability,

reflecting net lower than previously estimated future costs to remediate the impacted customer products. The supplier component

remediation liability was $408 million and $670 million as of July 25, 2015 and July 26, 2014, respectively.

(g) Indemnifications

In the normal course of business, the Company indemnifies other parties, including customers, lessors, and parties to other

transactions with the Company, with respect to certain matters. The Company has agreed to hold such parties harmless against losses

arising from a breach of representations or covenants or out of intellectual property infringement or other claims made against certain

parties. These agreements may limit the time within which an indemnification claim can be made and the amount of the claim.

The Company has an obligation to indemnify certain expenses pursuant to such an agreement in, among other cases, cases

involving certain of the Company’s service provider customers that are subject to patent infringement claims asserted by Sprint

Communications Company, L.P. (“Sprint”) in the U.S. District Court for the District of Kansas filed on December 19, 2011

(including one case that was later transferred to the District of Delaware). Sprint alleges that the service provider customers

infringe Sprint’s patents by offering Voice over Internet Protocol-based telephone services utilizing products provided by the

Company and other manufacturers. Sprint seeks monetary damages. Sprint’s cases in Kansas include claims against Comcast and

Time Warner Cable, service provider customers of the Company. Although trial dates were originally set for the first half of

calendar year 2016 in the case proceeding in the District of Kansas, at the request of Sprint and Comcast, the judge in Sprint’s

Kansas action ordered a six-month stay of the patent litigation between those parties for them to pursue a resolution of their

dispute. In addition, on May 15, 2015 the judge in Sprint’s Delaware action against the Company’s service provider customer

Cox Communications (“Cox”) granted defendant Cox’s motion for partial summary judgment that six patents owned by Sprint

are invalid. Cox then asked the judge to enter a final judgment on those six patents in order to conclude the district court

proceedings on those patents and to allow the parties to pursue any appeals. In May 2015, the Company filed two declaratory

judgment actions against Sprint seeking declarations that the patents Sprint asserted against the Company’s customers are invalid

and/or not infringed. On August 27, 2015 the judge in Delaware granted Cox’s request and entered a final judgment of invalidity

on those six patents; the Company expects Sprint to pursue an appeal.

107