Cisco 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

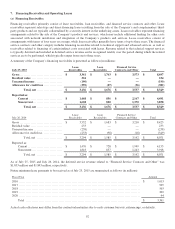

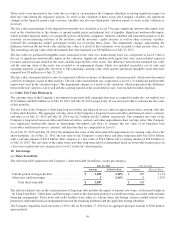

of either unbilled or current financing receivables included in the category of 91 days plus past due for financing receivables were

$496 million and $334 million as of July 25, 2015 and July 26, 2014, respectively.

As of July 25, 2015, the Company had financing receivables of $70 million, net of unbilled or current receivables from the same

contract, that were in the category of 91 days plus past due but remained on accrual status as they are well secured and in the

process of collection. Such balance was $78 million as of July 26, 2014.

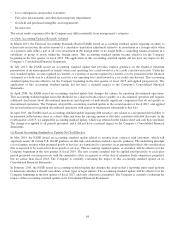

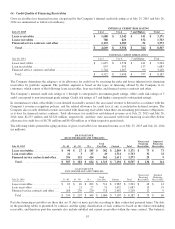

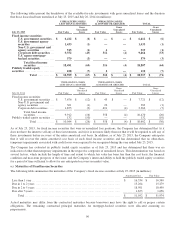

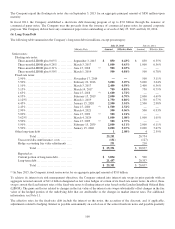

(c) Allowance for Credit Loss Rollforward

The allowances for credit loss and the related financing receivables are summarized as follows (in millions):

CREDIT LOSS ALLOWANCES

Lease

Receivables

Loan

Receivables

Financed Service

Contracts and Other Total

Allowance for credit loss as of July 26, 2014 ......... $ 233 $ 98 $ 18 $ 349

Provisions ............................................. 45 (8) 20 57

Recoveries (write-offs), net ........................... (7) 1 (1) (7)

Foreign exchange and other .......................... (12) (4) (1) (17)

Allowance for credit loss as of July 25, 2015 ......... $ 259 $ 87 $ 36 $ 382

Financing receivables as of July 25, 2015 (1) .......... $ 3,395 $ 1,763 $ 3,573 $ 8,731

CREDIT LOSS ALLOWANCES

Lease

Receivables

Loan

Receivables

Financed Service

Contracts and Other Total

Allowance for credit loss as of July 27, 2013 ........... $ 238 $ 86 $ 20 $ 344

Provisions ............................................. 4 9 1 14

Recoveries (write-offs), net ............................ (11) 5 (3) (9)

Foreign exchange and other ............................ 2 (2) — —

Allowance for credit loss as of July 26, 2014 ........... $ 233 $ 98 $ 18 $ 349

Financing receivables as of July 26, 2014 (1) ............ $ 3,527 $ 1,683 $ 3,210 $ 8,420

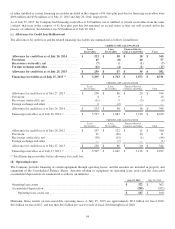

CREDIT LOSS ALLOWANCES

Lease

Receivables

Loan

Receivables

Financed Service

Contracts and Other Total

Allowance for credit loss as of July 28, 2012 ........... $ 247 $ 122 $ 11 $ 380

Provisions ............................................. 21 (20) 10 11

Recoveries (write-offs), net ............................ (30) (15) (1) (46)

Foreign exchange and other ............................ — (1) — (1)

Allowance for credit loss as of July 27, 2013 ........... $ 238 $ 86 $ 20 $ 344

Financing receivables as of July 27, 2013 (1) ............ $ 3,507 $ 1,649 $ 3,136 $ 8,292

(1) Total financing receivables before allowance for credit loss.

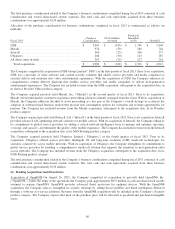

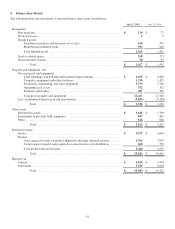

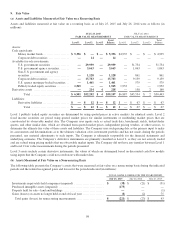

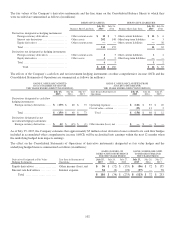

(d) Operating Leases

The Company provides financing of certain equipment through operating leases, and the amounts are included in property and

equipment in the Consolidated Balance Sheets. Amounts relating to equipment on operating lease assets and the associated

accumulated depreciation are summarized as follows (in millions):

July 25, 2015 July 26, 2014

Operating lease assets ....................................................................... $ 372 $ 362

Accumulated depreciation ................................................................... (205) (202)

Operating lease assets, net .............................................................. $ 167 $ 160

Minimum future rentals on non-cancelable operating leases at July 25, 2015 are approximately $0.2 billion for fiscal 2016,

$0.1 billion for fiscal 2017, and less than $0.1 billion per year for each of fiscal 2018 through fiscal 2020.

94