Cisco 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

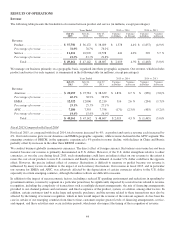

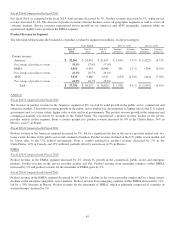

NGN Routing

Fiscal 2015 Compared with Fiscal 2014

Revenue in our NGN Routing product category increased by 1%, or $95 million, driven by a 6%, or $248 million, increase in

revenue from our high-end router products and a slight increase in revenue from our midrange and low-end router products,

partially offset by 28%, or $171 million, decrease in revenue from other NGN Routing products. Revenue from high-end router

products increased due to an increase in revenue from most products within our Cisco ASR category and the adoption of our

Cisco NCS platform and CRS-X, partially offset by lower sales of our legacy high-end router products. The slight increase in

revenue from our midrange and low-end router products was due to higher sales of our Cisco ISR products, partially offset by

lower sales of certain of our access products. Revenue from other NGN Routing products decreased primarily due to lower sales

of certain optical networking products.

Fiscal 2014 Compared with Fiscal 2013

The decrease in revenue in our NGN Routing product category of 7%, or $559 million, was driven by a 6%, or $278 million,

decrease in revenue from high-end router products; an 8%, or $227 million, decrease in revenue from our midrange and low-end

router products; and an 8%, or $54 million, decrease in revenue from other NGN Routing products. Revenue from our high-end

products decreased due to lower sales of Cisco CRS-3 Carrier Routing System products and our legacy high-end router products,

partially offset by increased sales of our Cisco ASR edge products. The decrease in revenue from our midrange and low-end

router products was driven by lower sales of our Cisco ISR products. Revenue from other NGN Routing products decreased due

to lower sales of certain optical networking products.

Collaboration

Fiscal 2015 Compared with Fiscal 2014

Revenue in our Collaboration product category increased by 5%, or $185 million, due to increased revenue from our Unified

Communications products as a result of higher software revenue and a slight increase in revenue from phones. Higher revenue

from our Cisco TelePresence and conferencing products also contributed to the increase. Revenue from Cisco TelePresence

products increased due to higher revenue in endpoint products as a result of new product introductions. The increase in

conferencing revenue was a result of higher recurring revenue. We continue to increase the amount of deferred revenue and the

proportion of recurring revenue related to our Collaboration product category.

Fiscal 2014 Compared with Fiscal 2013

We continue to increase the proportion of recurring revenue in our Collaboration product category. Overall, revenue in our

Collaboration product category decreased by 6%, or $242 million, primarily due to decreased revenue from our Cisco

TelePresence and Unified Communications products, driven by weakness in endpoint products such as phones. These decreases

were partially offset by higher revenue from our conferencing products.

Service Provider Video

Fiscal 2015 Compared with Fiscal 2014

The decrease in revenue from our Service Provider Video product category of 10%, or $414 million, was driven by a 16%, or

$332 million, decrease in sales of our Service Provider Video infrastructure products, due primarily to lower sales of set-top

boxes. We also experienced a decrease in revenue from cable access products within this product category.

On July 22, 2015, we entered into an exclusive agreement to sell the client premises equipment portion of our Service Provider

Video connected devices business unit to French-based Technicolor. We will continue to refocus our investments in Service

Provider Video towards cloud, security and software-based services.

Fiscal 2014 Compared with Fiscal 2013

Revenue in our Service Provider Video product category decreased by 18%, or $886 million, with the largest driver of the decline

being a 21%, or $812 million, decrease in sales of our Service Provider Video infrastructure products. The revenue decline in

Service Provider Video infrastructure products, which includes connected devices products, was due primarily to lower sales of

set-top boxes.

48