Cisco 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

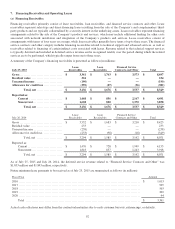

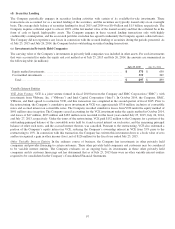

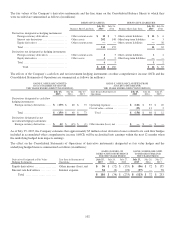

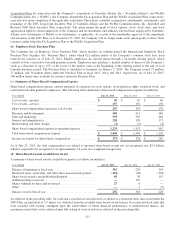

The fair values of the Company’s derivative instruments and the line items on the Consolidated Balance Sheets to which they

were recorded are summarized as follows (in millions):

DERIVATIVE ASSETS DERIVATIVE LIABILITIES

Balance Sheet Line Item

July 25,

2015

July 26,

2014 Balance Sheet Line Item

July 25,

2015

July 26,

2014

Derivatives designated as hedging instruments:

Foreign currency derivatives ................. Other current assets $10$ 7 Other current liabilities $11$6

Interest rate derivatives ...................... Other assets 202 148 Other long-term liabilities —3

Equity derivatives ........................... Other current assets —— Other current liabilities —56

Total ........................................ 212 155 11 65

Derivatives not designated as hedging instruments:

Foreign currency derivatives ................. Other current assets 23 Other current liabilities 12

Equity derivatives ........................... Other assets 42 Other long-term liabilities ——

Total ........................................ 6512

Total ................................... $ 218 $ 160 $12$67

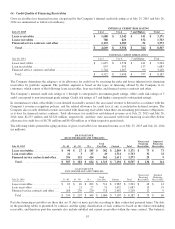

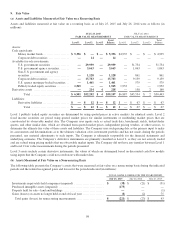

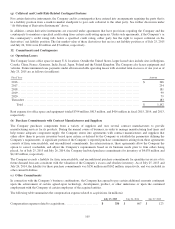

The effects of the Company’s cash flow and net investment hedging instruments on other comprehensive income (OCI) and the

Consolidated Statements of Operations are summarized as follows (in millions):

GAINS (LOSSES) RECOGNIZED

IN OCI ON DERIVATIVES FOR

THE YEARS ENDED (EFFECTIVE PORTION)

GAINS (LOSSES) RECLASSIFIED FROM

AOCI INTO INCOME FOR

THE YEARS ENDED (EFFECTIVE PORTION)

July 25,

2015

July 26,

2014

July 27,

2013

Line Item in Statements of

Operations

July 25,

2015

July 26,

2014

July 27,

2013

Derivatives designated as cash flow

hedging instruments:

Foreign currency derivatives ..... $ (159) $ 48 $ 73 Operating expenses ................ $ (121) $55$10

Cost of sales—service ............. (33) 13 2

Total .......................... $ (159) $ 48 $ 73 Total ......................... $ (154) $68$12

Derivatives designated as net

investment hedging instruments:

Foreign currency derivatives ..... $42$ (15) $ (1) Other income (loss), net ........... $—$—$—

As of July 25, 2015, the Company estimates that approximately $5 million of net derivative losses related to its cash flow hedges

included in accumulated other comprehensive income (AOCI) will be reclassified into earnings within the next 12 months when

the underlying hedged item impacts earnings.

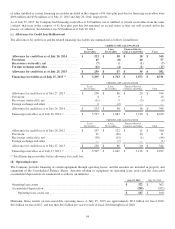

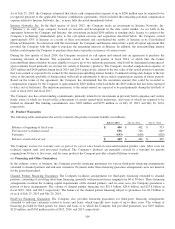

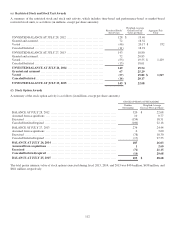

The effect on the Consolidated Statements of Operations of derivative instruments designated as fair value hedges and the

underlying hedged items is summarized as follows (in millions):

GAINS (LOSSES) ON

DERIVATIVE INSTRUMENTS

FOR THE YEARS ENDED

GAINS (LOSSES) RELATED

TO HEDGED ITEMS FOR

THE YEARS ENDED

Derivatives Designated as Fair Value

Hedging Instruments

Line Item in Statements of

Operations

July 25,

2015

July 26,

2014

July 27,

2013

July 25,

2015

July 26,

2014

July 27,

2013

Equity derivatives .................. Other income (loss), net $56$ (72) $ (155) $ (56) $72$155

Interest rate derivatives ............. Interest expense 54 (2) (78) (57) —78

Total .......................... $ 110 $ (74) $ (233) $ (113) $72$233

102