Cisco 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LIQUIDITY AND CAPITAL RESOURCES

The following sections discuss the effects of changes in our balance sheet, our capital allocation strategy including stock repurchase

program and dividends, our contractual obligations, and certain other commitments and activities on our liquidity and capital resources.

Balance Sheet and Cash Flows

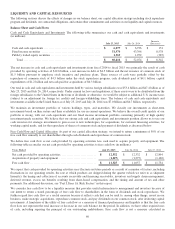

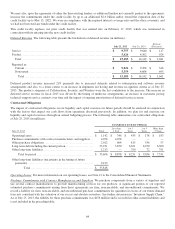

Cash and Cash Equivalents and Investments The following table summarizes our cash and cash equivalents and investments

(in millions):

July 25, 2015 July 26, 2014

Increase

(Decrease)

Cash and cash equivalents ................................................ $ 6,877 $ 6,726 $ 151

Fixed income securities .................................................. 51,974 43,396 8,578

Publicly traded equity securities .......................................... 1,565 1,952 (387)

Total ................................................................. $ 60,416 $ 52,074 $ 8,342

The net increase in cash and cash equivalents and investments from fiscal 2014 to fiscal 2015 was primarily the result of cash

provided by operating activities of $12.6 billion, a net increase in debt of $4.5 billion and the net issuance of common stock of

$1.5 billion pursuant to employee stock incentive and purchase plans. These sources of cash were partially offset by the

repurchase of common stock of $4.3 billion under the stock repurchase program, cash dividends paid of $4.1 billion, capital

expenditures of $1.2 billion and net cash paid for acquisitions of $0.3 billion.

Our total in cash and cash equivalents and investments held by various foreign subsidiaries was $53.4 billion and $47.4 billion as of

July 25, 2015 and July 26, 2014, respectively. Under current tax laws and regulations, if these assets were to be distributed from the

foreign subsidiaries to the United States in the form of dividends or otherwise, we would be subject to additional U.S. income taxes

(subject to an adjustment for foreign tax credits) and foreign withholding taxes. The balance of cash and cash equivalents and

investments available in the United States as of July 25, 2015 and July 26, 2014 was $7.0 billion and $4.7 billion, respectively.

We maintain an investment portfolio of various holdings, types, and maturities. We classify our investments as short-term

investments based on their nature and their availability for use in current operations. We believe the overall credit quality of our

portfolio is strong, with our cash equivalents and our fixed income investment portfolio consisting primarily of high quality

investment-grade securities. We believe that our strong cash and cash equivalents and investments position allows us to use our

cash resources for strategic investments to gain access to new technologies, for acquisitions, for customer financing activities, for

working capital needs, and for the repurchase of shares of common stock and payment of dividends as discussed below.

Free Cash Flow and Capital Allocation As part of our capital allocation strategy, we intend to return a minimum of 50% of our

free cash flow annually to our shareholders through cash dividends and repurchases of common stock.

We define free cash flow as net cash provided by operating activities less cash used to acquire property and equipment. The

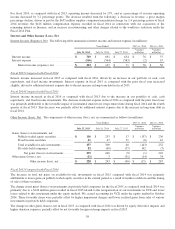

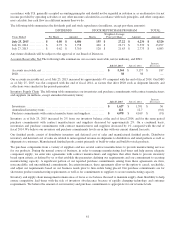

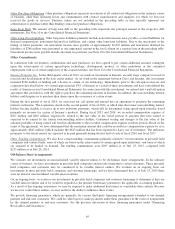

following table reconciles our net cash provided by operating activities to free cash flow (in millions):

Years Ended July 25, 2015 July 26, 2014 July 27, 2013

Net cash provided by operating activities ............................. $ 12,552 $ 12,332 $ 12,894

Acquisition of property and equipment ............................... (1,227) (1,275) (1,160)

Free cash flow ........................................................ $ 11,325 $ 11,057 $ 11,734

We expect that cash provided by operating activities may fluctuate in future periods as a result of a number of factors, including

fluctuations in our operating results, the rate at which products are shipped during the quarter (which we refer to as shipment

linearity), the timing and collection of accounts receivable and financing receivables, inventory and supply chain management,

deferred revenue, excess tax benefits resulting from share-based compensation, and the timing and amount of tax and other

payments. For additional discussion, see “Part I, Item 1A. Risk Factors” in this report.

We consider free cash flow to be a liquidity measure that provides useful information to management and investors because of

our intent to return a stated percentage of free cash flow to shareholders in the form of dividends and stock repurchases. We

further regard free cash flow as a useful measure because it reflects cash that can be used to, among other things, invest in our

business, make strategic acquisitions, repurchase common stock, and pay dividends on our common stock, after deducting capital

investments. A limitation of the utility of free cash flow as a measure of financial performance and liquidity is that the free cash

flow does not represent the total increase or decrease in our cash balance for the period. In addition, we have other required uses

of cash, including repaying the principal of our outstanding indebtedness. Free cash flow is not a measure calculated in

60