Cisco 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

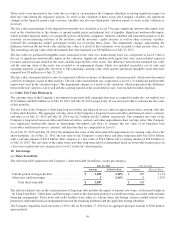

on the floating-rate notes. Each of the senior fixed-rate notes is redeemable by the Company at any time, subject to a make-whole

premium.

The senior notes rank at par with the commercial paper notes that may be issued in the future pursuant to the Company’s short-

term debt financing program, as discussed above under “(a) Short-Term Debt.” As of July 25, 2015, the Company was in

compliance with all debt covenants.

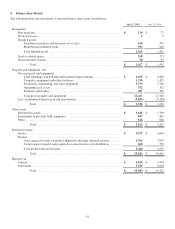

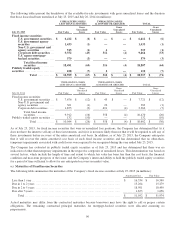

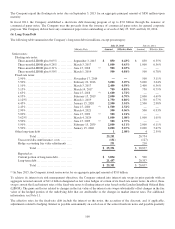

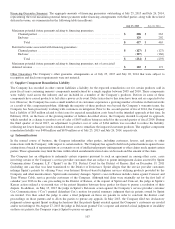

As of July 25, 2015, future principal payments for long-term debt, including the current portion, are summarized as follows (in

millions):

Fiscal Year Amount

2016 ........................................................................................................ $ 3,850

2017 ........................................................................................................ 4,151

2018 ........................................................................................................ 2,500

2019 ........................................................................................................ 4,250

2020 ........................................................................................................ 4,000

Thereafter ................................................................................................... 6,500

Total ................................................................................................... $ 25,251

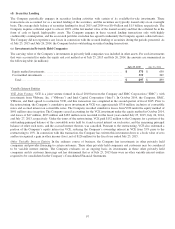

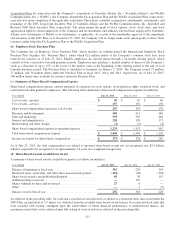

(c) Credit Facility

On May 15, 2015, the Company entered into a credit agreement with certain institutional lenders that provides for a $3.0 billion

unsecured revolving credit facility that is scheduled to expire on May 15, 2020. Any advances under the credit agreement will

accrue interest at rates that are equal to, based on certain conditions, either (i) the highest of (a) the Federal Funds rate plus

0.50%, (b) Bank of America’s “prime rate” as announced from time to time, or (c) LIBOR, or a comparable or successor rate that

is approved by the Administrative Agent (“Eurocurrency Rate”), for an interest period of one-month plus 1.00%, or (ii) the

Eurocurrency Rate, plus a margin that is based on the Company’s senior debt credit ratings as published by Standard & Poor’s

Financial Services, LLC and Moody’s Investors Service, Inc., provided that in no event will the Eurocurrency Rate be less than

zero. The credit agreement requires the Company to comply with certain covenants, including that it maintain an interest

coverage ratio as defined in the agreement.

The Company may also, upon the agreement of either the then-existing lenders or additional lenders not currently parties to the

agreement, increase the commitments under the credit facility by up to an additional $2.0 billion and/or extend the expiration date

of the credit facility up to May 15, 2022. As of July 25, 2015, the Company was in compliance with the required interest coverage

ratio and the other covenants, and the Company had not borrowed any funds under the credit facility.

This credit facility replaces the Company’s prior credit facility that was entered into on February 17, 2012, which was terminated

in connection with its entering into the new credit facility.

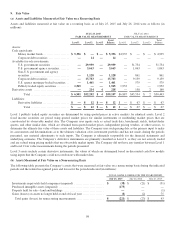

11. Derivative Instruments

(a) Summary of Derivative Instruments

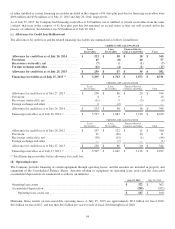

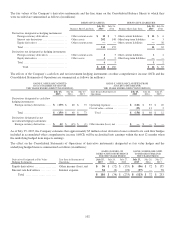

The Company uses derivative instruments primarily to manage exposures to foreign currency exchange rate, interest rate, and

equity price risks. The Company’s primary objective in holding derivatives is to reduce the volatility of earnings and cash flows

associated with changes in foreign currency exchange rates, interest rates, and equity prices. The Company’s derivatives expose it

to credit risk to the extent that the counterparties may be unable to meet the terms of the agreement. The Company does, however,

seek to mitigate such risks by limiting its counterparties to major financial institutions. In addition, the potential risk of loss with

any one counterparty resulting from this type of credit risk is monitored. Management does not expect material losses as a result

of defaults by counterparties.

101