Cisco 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

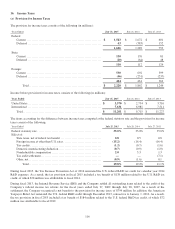

U.S. income taxes and foreign withholding taxes associated with the repatriation of earnings of foreign subsidiaries were not

provided for on a cumulative total of $58.0 billion of undistributed earnings for certain foreign subsidiaries as of the end of fiscal

2015. The Company intends to reinvest these earnings indefinitely in its foreign subsidiaries. If these earnings were distributed to

the United States in the form of dividends or otherwise, or if the shares of the relevant foreign subsidiaries were sold or otherwise

transferred, the Company would be subject to additional U.S. income taxes (subject to an adjustment for foreign tax credits) and

foreign withholding taxes. Determination of the amount of unrecognized deferred income tax liability related to these earnings is

not practicable.

As a result of certain employment and capital investment actions, the Company’s income in certain foreign countries is subject to

reduced tax rates and in some cases is wholly exempt from taxes. A portion of these incentives expired at the end of fiscal 2015.

The majority of the remaining tax incentives will expire at the end of fiscal 2025. The gross income tax benefit attributable to tax

incentives was estimated to be $1.4 billion ($0.28 per diluted share) in fiscal 2015, of which approximately $0.5 billion ($0.10 per

diluted share) is based on tax incentives that expired at the end of fiscal 2015. As of the end of fiscal 2014 and fiscal 2013, the

gross income tax benefits attributable to tax incentives were estimated to be $1.3 billion and $1.4 billion ($0.25 and $0.26 per

diluted share) for the respective years. The gross income tax benefits were partially offset by accruals of U.S. income taxes on

undistributed earnings.

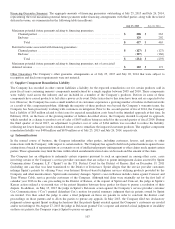

Unrecognized Tax Benefits

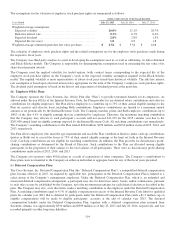

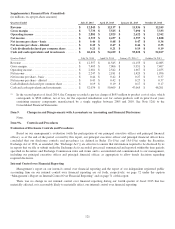

The aggregate changes in the balance of gross unrecognized tax benefits were as follows (in millions):

Years Ended July 25, 2015 July 26, 2014 July 27, 2013

Beginning balance ........................................................... $ 1,938 $ 1,775 $ 2,819

Additions based on tax positions related to the current year ................... 276 262 138

Additions for tax positions of prior years ..................................... 137 64 187

Reductions for tax positions of prior years .................................... (30) (13) (1,027)

Settlements .................................................................. (165) (17) (199)

Lapse of statute of limitations ................................................ (127) (133) (143)

Ending balance ............................................................... $ 2,029 $ 1,938 $ 1,775

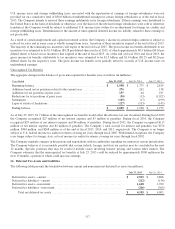

As of July 25, 2015, $1.7 billion of the unrecognized tax benefits would affect the effective tax rate if realized. During fiscal 2015

the Company recognized $27 million of net interest expense and $3 million of penalties. During fiscal 2014, the Company

recognized $29 million of net interest expense and $8 million of penalties. During fiscal 2013, the Company recognized $115

million of net interest expense and $2 million of penalties. The Company’s total accrual for interest and penalties was $274

million, $304 million, and $268 million as of the end of fiscal 2015, 2014, and 2013, respectively. The Company is no longer

subject to U.S. federal income tax audit for returns covering tax years through fiscal 2007. With limited exceptions, the Company

is no longer subject to foreign, state, or local income tax audits for returns covering tax years through fiscal 2002.

The Company regularly engages in discussions and negotiations with tax authorities regarding tax matters in various jurisdictions.

The Company believes it is reasonably possible that certain federal, foreign, and state tax matters may be concluded in the next

12 months. Specific positions that may be resolved include issues involving transfer pricing and various other matters. The

Company estimates that the unrecognized tax benefits at July 25, 2015 could be reduced by approximately $900 million in the

next 12 months, a portion of which could increase earnings.

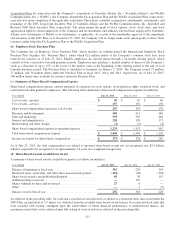

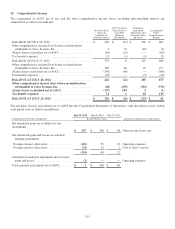

(b) Deferred Tax Assets and Liabilities

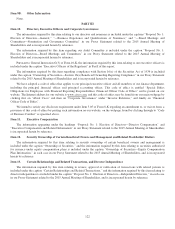

The following table presents the breakdown between current and noncurrent net deferred tax assets (in millions):

July 25, 2015 July 26, 2014

Deferred tax assets—current .................................................................. $ 2,915 $ 2,808

Deferred tax liabilities—current ............................................................... (212) (134)

Deferred tax assets—noncurrent ............................................................... 1,648 1,700

Deferred tax liabilities—noncurrent ........................................................... (246) (369)

Total net deferred tax assets .............................................................. $ 4,105 $ 4,005

117