Cisco 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

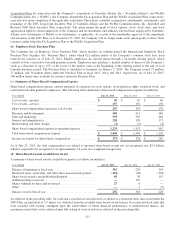

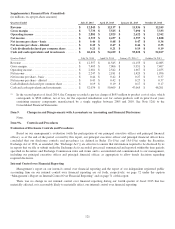

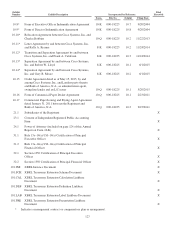

Supplementary Financial Data (Unaudited)

(in millions, except per-share amounts)

Quarters Ended July 25, 2015 April 25, 2015 January 24, 2015 October 25, 2014

Revenue .............................................. $ 12,843 $ 12,137 $ 11,936 $ 12,245

Gross margin ......................................... $ 7,733 $ 7,525 $ 7,090 $ 7,333

Operating income .................................... $ 2,881 $ 2,925 $ 2,622 $ 2,342

Net income ............................................ $ 2,319 $ 2,437 $ 2,397 $ 1,828

Net income per share - basic ......................... $ 0.46 $ 0.48 $ 0.47 $ 0.36

Net income per share - diluted ....................... $ 0.45 $ 0.47 $ 0.46 $ 0.35

Cash dividends declared per common share ......... $ 0.21 $ 0.21 $ 0.19 $ 0.19

Cash and cash equivalents and investments ......... $ 60,416 $ 54,419 $ 53,022 $ 52,107

Quarters Ended July 26, 2014 April 26, 2014 January 25, 2014 (1) October 26, 2013

Revenue ............................................... $ 12,357 $ 11,545 $ 11,155 $ 12,085

Gross margin .......................................... $ 7,405 $ 7,006 $ 5,951 $ 7,407

Operating income ...................................... $ 2,681 $ 2,542 $ 1,667 $ 2,455

Net income ............................................ $ 2,247 $ 2,181 $ 1,429 $ 1,996

Net income per share - basic ........................... $ 0.44 $ 0.42 $ 0.27 $ 0.37

Net income per share - diluted ......................... $ 0.43 $ 0.42 $ 0.27 $ 0.37

Cash dividends declared per common share ............ $ 0.19 $ 0.19 $ 0.17 $ 0.17

Cash and cash equivalents and investments ............ $ 52,074 $ 50,469 $ 47,065 $ 48,201

(1) In the second quarter of fiscal 2014, the Company recorded a pre-tax charge of $655 million to product cost of sales, which

corresponds to $526 million, net of tax, for the expected remediation cost for certain products sold in prior fiscal years

containing memory components manufactured by a single supplier between 2005 and 2010. See Note 12(f) to the

Consolidated Financial Statements.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosures

None.

Item 9A. Controls and Procedures

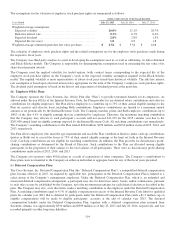

Evaluation of Disclosure Controls and Procedures

Based on our management’s evaluation (with the participation of our principal executive officer and principal financial

officer), as of the end of the period covered by this report, our principal executive officer and principal financial officer have

concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities

Exchange Act of 1934, as amended, (the “Exchange Act”)) are effective to ensure that information required to be disclosed by us

in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods

specified in Securities and Exchange Commission rules and forms and is accumulated and communicated to our management,

including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding

required disclosure.

Internal Control over Financial Reporting

Management’s report on our internal control over financial reporting and the report of our independent registered public

accounting firm on our internal control over financial reporting are set forth, respectively, on page 72 under the caption

“Management’s Report on Internal Control Over Financial Reporting” and on page 71 of this report.

There was no change in our internal control over financial reporting during our fourth quarter of fiscal 2015 that has

materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

121