Cisco 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

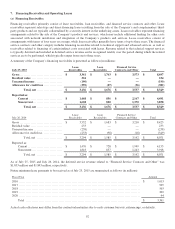

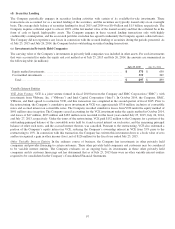

7. Financing Receivables and Operating Leases

(a) Financing Receivables

Financing receivables primarily consist of lease receivables, loan receivables, and financed service contracts and other. Lease

receivables represent sales-type and direct-financing leases resulting from the sale of the Company’s and complementary third-

party products and are typically collateralized by a security interest in the underlying assets. Loan receivables represent financing

arrangements related to the sale of the Company’s products and services, which may include additional funding for other costs

associated with network installation and integration of the Company’s products and services. Lease receivables consist of

arrangements with terms of four years on average, while loan receivables generally have terms of up to three years. The financed

service contracts and other category includes financing receivables related to technical support and advanced services, as well as

receivables related to financing of certain indirect costs associated with leases. Revenue related to the technical support services

is typically deferred and included in deferred service revenue and is recognized ratably over the period during which the related

services are to be performed, which typically ranges from one to three years.

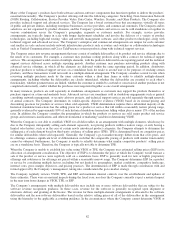

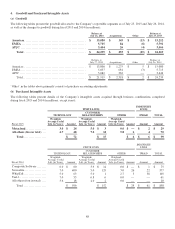

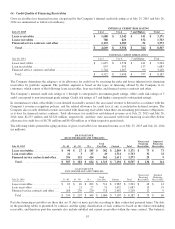

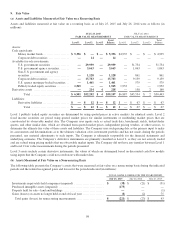

A summary of the Company’s financing receivables is presented as follows (in millions):

July 25, 2015

Lease

Receivables

Loan

Receivables

Financed Service

Contracts and Other Total

Gross .................................... $ 3,361 $ 1,763 $ 3,573 $ 8,697

Residual value .......................... 224 — — 224

Unearned income ....................... (190) — — (190)

Allowance for credit loss ................ (259) (87) (36) (382)

Total, net ...................... $ 3,136 $ 1,676 $ 3,537 $ 8,349

Reported as:

Current ............................ $ 1,468 $ 856 $ 2,167 $ 4,491

Noncurrent ......................... 1,668 820 1,370 3,858

Total, net ...................... $ 3,136 $ 1,676 $ 3,537 $ 8,349

July 26, 2014

Lease

Receivables

Loan

Receivables

Financed Service

Contracts and Other Total

Gross .................................... $ 3,532 $ 1,683 $ 3,210 $ 8,425

Residual value ........................... 233 — — 233

Unearned income ........................ (238) — — (238)

Allowance for credit loss ................. (233) (98) (18) (349)

Total, net ...................... $ 3,294 $ 1,585 $ 3,192 $ 8,071

Reported as:

Current ............................. $ 1,476 $ 728 $ 1,949 $ 4,153

Noncurrent .......................... 1,818 857 1,243 3,918

Total, net ...................... $ 3,294 $ 1,585 $ 3,192 $ 8,071

As of July 25, 2015 and July 26, 2014, the deferred service revenue related to “Financed Service Contracts and Other” was

$1,853 million and $1,843 million, respectively.

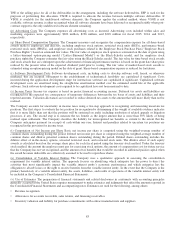

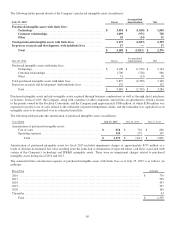

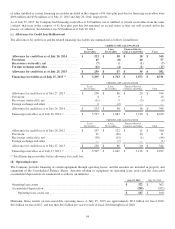

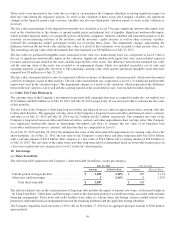

Future minimum lease payments to be received as of July 25, 2015 are summarized as follows (in millions):

Fiscal Year Amount

2016 ....................................................................................................... $ 1,613

2017 ....................................................................................................... 999

2018 ....................................................................................................... 503

2019 ....................................................................................................... 202

2020 ....................................................................................................... 44

Total ................................................................................................. $ 3,361

Actual cash collections may differ from the contractual maturities due to early customer buyouts, refinancings, or defaults.

92