Cisco 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The total purchase consideration related to the Company’s business combinations completed during fiscal 2014 consisted of cash

consideration and vested share-based awards assumed. The total cash and cash equivalents acquired from these business

combinations was approximately $134 million.

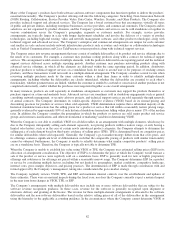

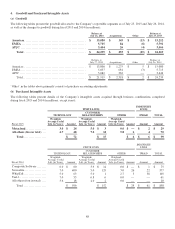

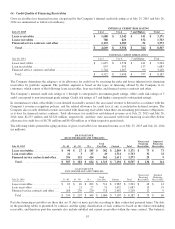

Allocation of the purchase consideration for business combinations completed in fiscal 2013 is summarized as follows (in

millions):

Fiscal 2013

Purchase

Consideration

Net Liabilities

Assumed

Purchased

Intangible

Assets Goodwill

NDS ..................................................... $ 5,005 $ (185) $ 1,746 $ 3,444

Meraki ................................................... 974 (59) 289 744

Intucell .................................................. 360 (23) 106 277

Ubiquisys ................................................ 280 (30) 123 187

All others (nine in total) .................................. 363 (25) 127 261

Total acquisitions ...................................... $ 6,982 $ (322) $ 2,391 $ 4,913

The Company completed its acquisition of NDS Group Limited (“NDS”) in the first quarter of fiscal 2013. Prior to its acquisition,

NDS was a provider of video software and content security solutions that enable service providers and media companies to

securely deliver and monetize new video entertainment experiences. With the acquisition of NDS, the Company enhances its

comprehensive content delivery platform that enables service providers and media companies to deliver next-generation

entertainment experiences. The Company has included revenue from the NDS acquisition, subsequent to the acquisition date, in

its Service Provider Video product category.

The Company acquired privately held Meraki, Inc. (“Meraki”) in the second quarter of fiscal 2013. Prior to its acquisition,

Meraki offered mid-market customers on-premise networking solutions centrally managed from the cloud. With its acquisition of

Meraki, the Company addresses the shift to cloud networking as a key part of the Company’s overall strategy to accelerate the

adoption of software-based business models that provide new consumption options for customers and revenue opportunities for

partners. The Company has included revenue from the Meraki acquisition, subsequent to the acquisition date, in its Wireless

product category.

The Company acquired privately held Intucell, Ltd. (“Intucell”) in the third quarter of fiscal 2013. Prior to its acquisition, Intucell

provided advanced self-optimizing network software for mobile carriers. With its acquisition of Intucell, the Company enhances

its commitment to global service providers by adding a critical network intelligence layer to manage and optimize spectrum,

coverage, and capacity, and ultimately the quality of the mobile experience. The Company has included revenue from the Intucell

acquisition, subsequent to the acquisition date, in its NGN Routing product category.

The Company acquired privately held Ubiquisys Limited (“Ubiquisys”) in the fourth quarter of fiscal 2013. Prior to its

acquisition, Ubiquisys offered service providers intelligent 3G and long-term evolution (LTE) small-cell technologies for

seamless connectivity across mobile networks. With its acquisition of Ubiquisys, the Company strengthens its commitment to

global service providers by enabling a comprehensive small-cell solution that supports the transition to next-generation radio

access networks. The Company has included revenue from the Ubiquisys acquisition, subsequent to the acquisition date, in its

NGN Routing product category.

The total purchase consideration related to the Company’s business combinations completed during fiscal 2013 consisted of cash

consideration and vested share-based awards assumed. The total cash and cash equivalents acquired from these business

combinations was approximately $156 million.

(b) Pending Acquisitions and Divestitures

Acquisition of OpenDNS On August 26, 2015, the Company completed its acquisition of privately held OpenDNS, Inc.

(“OpenDNS”). Under the terms of the agreement, the Company paid approximately $635 million in cash and share-based awards

assumed to acquire OpenDNS. OpenDNS provides advanced threat protection for endpoint devices. With the OpenDNS

acquisition, the Company aims to strengthen its security offerings by adding broad visibility and threat intelligence delivered

through a software-as-a-service platform. Revenue from the OpenDNS acquisition will be included in the Company’s Security

product category. The Company expects that most of the purchase price will be allocated to goodwill and purchased intangible

assets.

86