Cisco 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

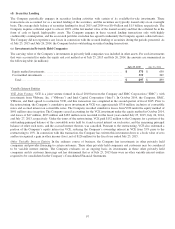

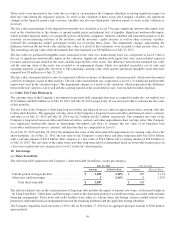

(d) Securities Lending

The Company periodically engages in securities lending activities with certain of its available-for-sale investments. These

transactions are accounted for as a secured lending of the securities, and the securities are typically loaned only on an overnight

basis. The average daily balance of securities lending for fiscal 2015 and 2014 was $0.4 billion and $1.5 billion, respectively. The

Company requires collateral equal to at least 102% of the fair market value of the loaned security and that the collateral be in the

form of cash or liquid, high-quality assets. The Company engages in these secured lending transactions only with highly

creditworthy counterparties, and the associated portfolio custodian has agreed to indemnify the Company against collateral losses.

The Company did not experience any losses in connection with the secured lending of securities during the periods presented. As

of July 25, 2015 and July 26, 2014, the Company had no outstanding securities lending transactions.

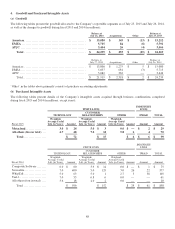

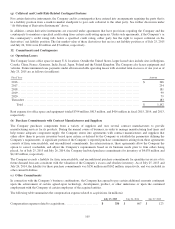

(e) Investments in Privately Held Companies

The carrying value of the Company’s investments in privately held companies was included in other assets. For such investments

that were accounted for under the equity and cost method as of July 25, 2015 and July 26, 2014, the amounts are summarized in

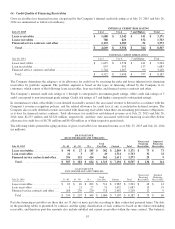

the following table (in millions):

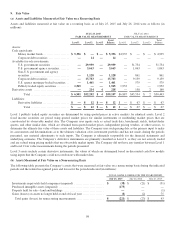

July 25, 2015 July 26, 2014

Equity method investments ................................................................. $ 578 $ 630

Cost method investments ................................................................... 319 269

Total ..................................................................................... $ 897 $ 899

Variable Interest Entities

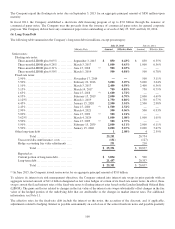

VCE Joint Venture VCE is a joint venture formed in fiscal 2010 between the Company and EMC Corporation (“EMC”), with

investments from VMware, Inc. (“VMware”) and Intel Capital Corporation (“Intel”). In October 2014, the Company, EMC,

VMware, and Intel agreed to restructure VCE, and this transaction was completed in the second quarter of fiscal 2015. Prior to

the restructuring, the Company’s cumulative gross investment in VCE was approximately $716 million, inclusive of convertible

notes and accrued interest on convertible notes. The Company recorded cumulative losses from VCE under the equity method of

$691 million since inception. The Company ceased accounting for the VCE investment under the equity method in October 2014,

and losses of $47 million, $223 million and $183 million were recorded for the fiscal years ended July 25, 2015, July 26, 2014,

and July 27, 2013, respectively. Under the terms of the restructuring, VCE paid $152 million to the Company for a portion of the

outstanding principal balance of the convertible notes held by it and accrued interest on such notes, and the remaining principal

balance of other such notes, and the accrued interest thereon, was cancelled. Pursuant to the restructuring, VCE also redeemed a

portion of the Company’s equity interest in VCE, reducing the Company’s ownership interest in VCE from 35% prior to the

restructuring to 10%. In connection with this transaction, the Company has written this investment down to a book value of zero

and has recognized a gain in other income (loss), net of $126 million for the fiscal year ended July 25, 2015.

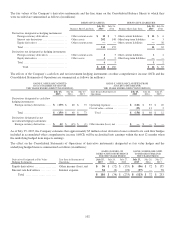

Other Variable Interest Entities In the ordinary course of business, the Company has investments in other privately held

companies and provides financing to certain customers. These other privately held companies and customers may be considered

to be variable interest entities. The Company evaluates on an ongoing basis its investments in these other privately held

companies and its customer financings and has determined that as of July 25, 2015 there were no other variable interest entities

required to be consolidated in the Company’s Consolidated Financial Statements.

97