Cisco 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

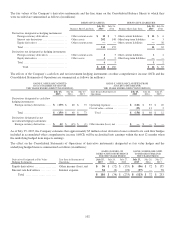

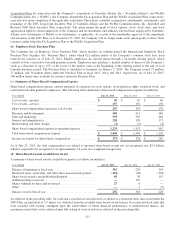

As of July 25, 2015, the Company estimated that future cash compensation expense of up to $296 million may be required to be

recognized pursuant to the applicable business combination agreements, which included the remaining potential compensation

expense related to Insieme Networks, Inc., as more fully discussed immediately below.

Insieme Networks, Inc. In the third quarter of fiscal 2012, the Company made an investment in Insieme Networks, Inc.

(“Insieme”), an early stage company focused on research and development in the data center market. As set forth in the

agreement between the Company and Insieme, this investment included $100 million of funding and a license to certain of the

Company’s technology. Immediately prior to the call option exercise and acquisition described below, the Company owned

approximately 83% of Insieme as a result of these investments and consolidated the results of Insieme in its Consolidated

Financial Statements. In connection with this investment, the Company and Insieme entered into a put/call option agreement that

provided the Company with the right to purchase the remaining interests in Insieme. In addition, the noncontrolling interest

holders could require the Company to purchase their shares upon the occurrence of certain events.

During the first quarter of fiscal 2014, the Company exercised its call option and entered into an agreement to purchase the

remaining interests in Insieme. The acquisition closed in the second quarter of fiscal 2014, at which time the former

noncontrolling interest holders became eligible to receive up to two milestone payments, which will be determined using agreed-

upon formulas based primarily on revenue for certain of Insieme’s products. The Company recorded compensation expense of

$207 million and $416 million during fiscal 2015 and 2014, respectively, related to the fair value of the vested portion of amounts

that were earned or expected to be earned by the former noncontrolling interest holders. Continued vesting and changes to the fair

value of the amounts probable of being earned will result in adjustments to the recorded compensation expense in future periods.

Based on the terms of the agreement, the Company has determined that the maximum amount that could be recorded as

compensation expense by the Company is approximately $843 million (which includes the $623 million that has been expensed

to date), net of forfeitures. The milestone payments, to the extent earned, are expected to be paid primarily during the first half of

each of fiscal 2016 and fiscal 2017.

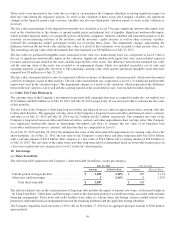

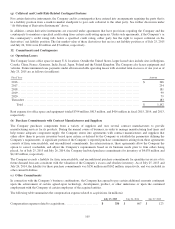

The Company also has certain funding commitments, primarily related to its investments in privately held companies and venture

funds, some of which are based on the achievement of certain agreed-upon milestones, and some of which are required to be

funded on demand. The funding commitments were $205 million and $255 million as of July 25, 2015 and July 26, 2014,

respectively.

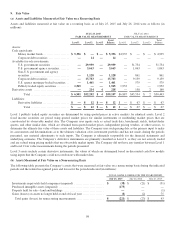

(d) Product Warranties

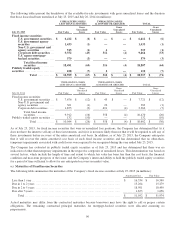

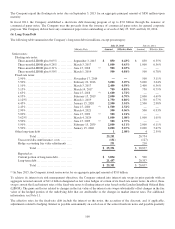

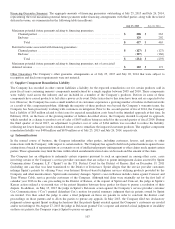

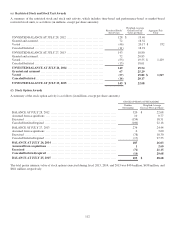

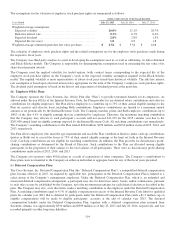

The following table summarizes the activity related to the product warranty liability (in millions):

July 25, 2015 July 26, 2014 July 27, 2013

Balance at beginning of fiscal year ......................................... $ 446 $ 402 $ 373

Provision for warranties issued ............................................ 696 704 649

Payments .................................................................. (693) (660) (620)

Balance at end of fiscal year ............................................... $ 449 $ 446 $ 402

The Company accrues for warranty costs as part of its cost of sales based on associated material product costs, labor costs for

technical support staff, and associated overhead. The Company’s products are generally covered by a warranty for periods

ranging from 90 days to five years, and for some products the Company provides a limited lifetime warranty.

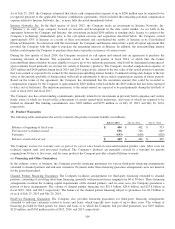

(e) Financing and Other Guarantees

In the ordinary course of business, the Company provides financing guarantees for various third-party financing arrangements

extended to channel partners and end-user customers. Payments under these financing guarantee arrangements were not material

for the periods presented.

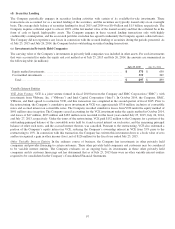

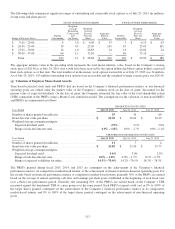

Channel Partner Financing Guarantees The Company facilitates arrangements for third-party financing extended to channel

partners, consisting of revolving short-term financing, generally with payment terms ranging from 60 to 90 days. These financing

arrangements facilitate the working capital requirements of the channel partners, and, in some cases, the Company guarantees a

portion of these arrangements. The volume of channel partner financing was $25.9 billion, $24.6 billion, and $23.8 billion in

fiscal 2015, 2014, and 2013, respectively. The balance of the channel partner financing subject to guarantees was $1.2 billion as

of each of July 25, 2015 and July 26, 2014.

End-User Financing Guarantees The Company also provides financing guarantees for third-party financing arrangements

extended to end-user customers related to leases and loans, which typically have terms of up to three years. The volume of

financing provided by third parties for leases and loans as to which the Company had provided guarantees was $107 million,

$129 million, and $185 million in fiscal 2015, 2014, and 2013, respectively.

106