Cisco 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

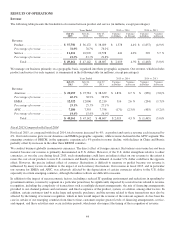

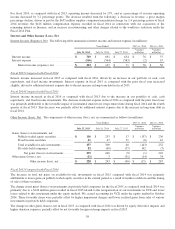

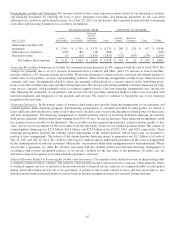

Gross Margin by Segment

The following table presents the total gross margin for each segment (in millions, except percentages):

AMOUNT PERCENTAGE

Years Ended July 25, 2015 July 26, 2014 July 27, 2013 July 25, 2015 July 26, 2014 July 27, 2013

Gross margin:

Americas .............................. $ 18,670 $ 17,379 $ 17,887 63.0% 62.6% 62.5%

EMEA ................................. 7,705 7,700 7,876 62.5% 64.1% 64.5%

APJC .................................. 4,307 4,252 4,637 60.0% 57.8% 59.8%

Segment total .......................... 30,682 29,331 30,400 62.4% 62.2% 62.5%

Unallocated corporate items (1) ......... (1,001) (1,562) (960)

Total ................................ $ 29,681 $ 27,769 $ 29,440 60.4% 58.9% 60.6%

(1) The unallocated corporate items for the years presented include the effects of amortization and impairments of acquisition-related intangible assets, share-

based compensation expense, significant litigation and other contingencies, impacts to cost of sales from purchase accounting adjustments to inventory, charges

related to asset impairments and restructurings, and certain other charges. We do not allocate these items to the gross margin for each segment because

management does not include such information in measuring the performance of the operating segments.

Fiscal 2015 Compared with Fiscal 2014

We experienced a gross margin percentage increase in our Americas segment due to productivity improvements partially offset

by unfavorable impacts from pricing. The product mix was flat in this geographic segment as the impact of decreased revenue

from our relatively lower margin Service Provider Video products offset the increase in revenue from our relatively lower margin

Cisco Unified Computing System products.

The gross margin percentage decrease in our EMEA segment was due primarily to unfavorable impacts from pricing and mix.

The unfavorable mix impact was driven by an increase in revenue from our relatively lower margin Cisco Unified Computing

System products. Lower service gross margin also contributed to the decrease in the overall gross margin in this segment.

The APJC segment gross margin percentage increased due to productivity improvements and a favorable mix impact, partially

offset by unfavorable impacts from pricing. The favorable mix impact was driven by a decrease in revenue from our relatively

lower margin Service Provider Video products and an increase in revenue from certain of our higher margin core products.

The gross margin percentage for a particular segment may fluctuate, and period-to-period changes in such percentages may or

may not be indicative of a trend for that segment. Our product and service gross margins may be impacted by economic

downturns or uncertain economic conditions as well as our movement into new market opportunities, and could decline if any of

the factors that impact our gross margins are adversely affected in future periods.

Fiscal 2014 Compared with Fiscal 2013

The Americas segment experienced a slight gross margin percentage increase due to the impact of productivity improvements in

this geographic segment. Partially offsetting this favorable impact to gross margin were negative impacts from pricing and an

unfavorable mix. The unfavorable mix impact was driven by revenue increases in our Cisco Unified Computing System products

and lower sales of our higher margin core products, partially offset by decreased revenue from our Service Provider Video

products.

The gross margin percentage decrease in our EMEA segment was due primarily to the unfavorable impacts from pricing, as well

as an unfavorable mix impact, partially offset by productivity improvements in this geographic segment. The unfavorable mix

impact was driven by an increase in revenue from our Cisco Unified Computing System products.

Our APJC segment gross margin percentage decreased primarily as a result of unfavorable impacts from pricing, and also as a

result of an unfavorable mix. The unfavorable mix impact was driven by an increase in revenue from our Cisco Unified

Computing System products. Partially offsetting these factors were impacts from productivity improvements and higher service

gross margin in this geographic segment.

53