Cisco 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

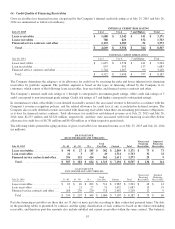

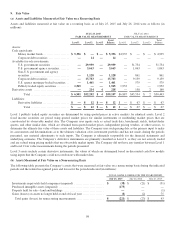

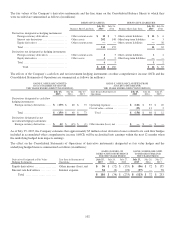

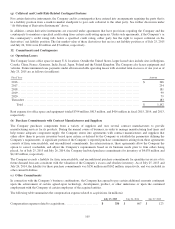

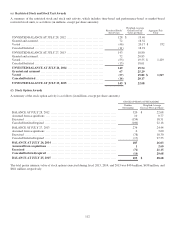

The effect on the Consolidated Statements of Operations of derivative instruments not designated as hedges is summarized as

follows (in millions):

GAINS (LOSSES) FOR

THE YEARS ENDED

Derivatives Not Designated as Hedging Instruments Line Item in Statements of Operations

July 25,

2015

July 26,

2014

July 27,

2013

Foreign currency derivatives ........................ Other income (loss), net $ (173) $ 23 $ (74)

Total return swaps—deferred compensation ........ Operating expenses 19 47 61

Equity derivatives .................................. Other income (loss), net 27 34 —

Total .......................................... $ (127) $ 104 $ (13)

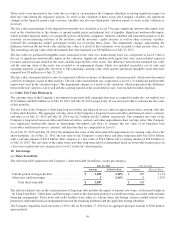

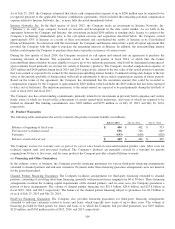

The notional amounts of the Company’s outstanding derivatives are summarized as follows (in millions):

July 25, 2015 July 26, 2014

Derivatives designated as hedging instruments:

Foreign currency derivatives—cash flow hedges ........................................ $ 1,201 $ 1,618

Interest rate derivatives ................................................................. 11,400 10,400

Net investment hedging instruments ..................................................... 192 345

Equity derivatives ...................................................................... —238

Derivatives not designated as hedging instruments:

Foreign currency derivatives ............................................................ 2,023 2,528

Total return swaps—deferred compensation ............................................. 462 428

Total ................................................................................. $ 15,278 $ 15,557

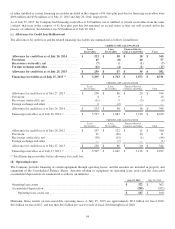

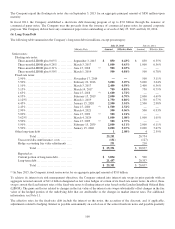

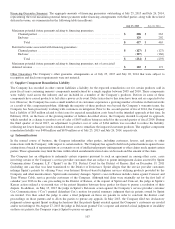

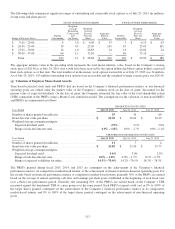

(b) Offsetting of Derivative Instruments

The Company presents its derivative instruments at gross fair values in the Consolidated Balance Sheets. However, the

Company’s master netting and other similar arrangements with the respective counterparties allow for net settlement under

certain conditions, which are designed to reduce credit risk by permitting net settlement with the same counterparty. To further

limit credit risk, the Company also enters into collateral security arrangements related to certain derivative instruments whereby

cash is posted as collateral between the counterparties based on the fair market value of the derivative instrument. Information

related to these offsetting arrangements is summarized as follows (in millions):

GROSS AMOUNTS OFFSET IN THE

CONSOLIDATED BALANCE SHEET

GROSS AMOUNTS NOT OFFSET IN THE

CONSOLIDATED BALANCE SHEET

BUT WITH LEGAL RIGHTS TO OFFSET

July 25, 2015

Gross Amounts

Recognized

Gross Amounts

Offset

Net Amounts

Presented

Gross Derivative

Amounts Cash Collateral Net Amount

Derivatives assets .................. $ 218 $ — $ 218 $ (12) $ (124) $ 82

Derivatives liabilities .............. $ 12 $ — $ 12 $ (12) $ — $ —

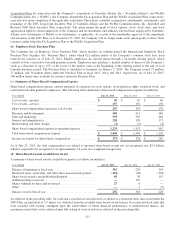

GROSS AMOUNTS OFFSET IN THE

CONSOLIDATED BALANCE SHEET

GROSS AMOUNTS NOT OFFSET IN THE

CONSOLIDATED BALANCE SHEET

BUT WITH LEGAL RIGHTS TO OFFSET

July 26, 2014

Gross Amounts

Recognized

Gross Amounts

Offset

Net Amounts

Presented

Gross Derivative

Amounts Cash Collateral Net Amount

Derivatives assets ...................$ 160 $ — $ 160 $ (39) $ (60) $ 61

Derivatives liabilities ...............$ 67 $ — $ 67 $ (39) $ (1) $ 27

103