Cisco 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

As of July 26, 2008, $2.1 billion of the unrecognized tax benefits would affect the effective tax rate if realized. The Company’s policy to

include interest and penalties related to income taxes, including unrecognized tax benefits, within the provision for income taxes did not

change as a result of implementing FIN 48. As of the date of adoption of FIN 48, the Company had accrued $183 million in income taxes

payable for the payment of interest and penalties. As of July 26, 2008, the Company had accrued $166 million in income taxes payable for

the payment of interest and penalties, of which $8 million was recorded to the provision for income taxes during fiscal 2008. The Company

is no longer subject to U.S. federal income tax audit for returns covering tax years through fiscal year 2001. With limited exceptions, the

Company is no longer subject to state and local or foreign income tax audits for returns covering tax years through fiscal year 1997.

Although timing of the resolution of audits is highly uncertain, the Company does not believe it is reasonably possible that the total amount

of unrecognized tax benefits as of July 26, 2008 will materially change in the next 12 months.

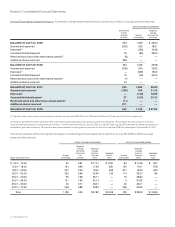

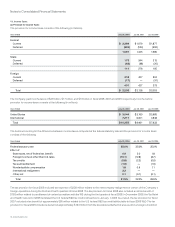

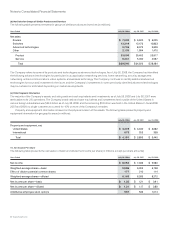

(c) Deferred Tax Assets and Liabilities

The following table presents the breakdown between current and noncurrent net deferred tax assets (in millions):

July 26, 2008 July 28, 2007

Deferred tax assets—current $ 2,066 $ 1,953

Deferred tax assets—noncurrent 1,770 1,060

Deferred tax liabilities—noncurrent (80) (71)

Total net deferred tax assets $ 3,756 $ 2,942

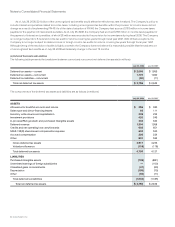

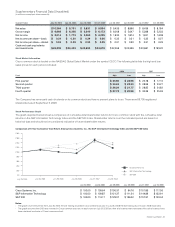

The components of the deferred tax assets and liabilities are as follows (in millions):

July 26, 2008 July 28, 2007

ASSETS

Allowance for doubtful accounts and returns $ 256 $ 330

Sales-type and direct-financing leases 93 111

Inventory write-downs and capitalization 239 222

Investment provisions 420 245

In-process R&D, goodwill, and purchased intangible assets 343 344

Deferred revenue 1,304 1,056

Credits and net operating loss carryforwards 602 651

SFAS 123(R) share-based compensation expense 603 520

Accrued compensation 226 234

Other 831 532

Gross deferred tax assets 4,917 4,245

Valuation allowance (118) (118)

Total deferred tax assets 4,799 4,127

LIABILITIES

Purchased intangible assets (709) (881)

Unremitted earnings of foreign subsidiaries — (100)

Unrealized gains on investments (47) (60)

Depreciation (195) (73)

Other (92) (71)

Total deferred tax liabilities (1,043) (1,185)

Total net deferred tax assets $ 3,756 $ 2,942